Substitution of new section for section 80E

Showing posts with label Income Tax Section 80EE. Show all posts

Showing posts with label Income Tax Section 80EE. Show all posts

Sunday, 13 March 2016

Here is a key to tax benefit on home loans as per 2016-2017 budget presented on Feb 29th 2016 applicable for financial year 2016-17 and assessment year 2017-18 as compared to previous year and practical tips to avail these to maximize your tax savings on home loans.

Download Income Tax Calculator forNon-Govt employees For the Financial Year 2016-17 & Assessment Year 2017-18as per the Finance Budget 2016-17 [All Tax Amended have in this Tax Calculator & inbuilt the Salary Structure of Non-Govt employees Salary Pattern ]

Key highlight of the budget is that first time home buyers will get additional exemption of up to Rs. 50,000/- on interest paid for loans up to Rs. 35 lakhs with cost of home upto Rs. 50 lakhs.U/s 80EE

Key highlight of the budget is that first time home buyers will get additional exemption of up to Rs. 50,000/- on interest paid for loans up to Rs. 35 lakhs with cost of home upto Rs. 50 lakhs.U/s 80EE

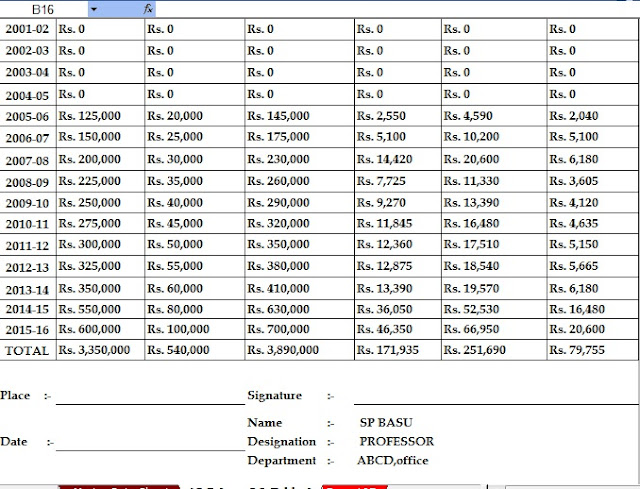

Download Automated Income TaxArrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2001-02 to F.Y.2016-17 ( Up dated Version )

Tax benefits on home loan in summary

Tax Benefits

|

On Principal Repaid

|

On Interest Paid

|

First Home – Self Occupied

|

No change – Upto Rs. One Lakh Fifty Thousand (Rs. Two Lakh for senior citizens)

|

Up to Rs. Two Lakh if completed within 3 years from the end of the fin. year in which loan is taken, else Rs. 30,000. Additional exemption of upto Rs. 50,000/- U/s 80EE on interest paid for loans upto Rs. 35 lakhs with cost of home up to Rs. 50 lakhs

|

First Home – Rented/ Vacant

|

No change – Upto Rs. One Lakh Fifty Thousand if staying in a different city for work

|

No change – On entire interest paid without any limit

|

Second Home

|

None

|

No change – On entire interest paid without any limit

|

Under Constrn.

|

None

|

No change – The interest paid can be claimed in equal parts in five fin. years post completion or handing over.

|

Income tax exemption on repayment of home loan principal amount up to Rs. 150,000 P.A. under Section 80 C of the Income Tax Act:

Key Highlights/ Terms to avail this exemption

· Principal repayment component of up to Rs. one lakh fifty thousand can be clubbed under the overall limit for tax saving instruments eligible under Section 80C

· Available only for purchase or construction of residential property

· Deduction available only for self occupied property

· Any amount paid towards partial or full prepayment of home loan is also eligible to be included for benefit under this section

Deduction of home loan interest paid for self occupied home up to Rs. 2,00,000 P.A. under Section 24 of the Income Tax Act

Key Highlights/Terms to avail this exemption

· Annual interest component of up to Rs. two lakh can be claimed as deduction against income and reduce the your tax liability by upto Rs. 67,980 depending upon your tax slab

· Additional exemption of up to Rs. 50,000 can be claimed as deduction against income from FY 2016-17 and AY 2017-18 on first home provided the sanctioned loan amount is upto Rs. 35 lakhs and cost of house is upto Rs. 50 lakhs U/s 80EE

· Available for purchase/ construction/ repair/ renewal/ reconstruction of a residential house property

· Benefit available only for self occupied property

· Deduction is available on an accrual basis and not on a payment basis. Hence, deduction under Section 24 can be claimed on yearly basis even if no payment has been made during the year but interest has accrued

Sunday, 1 February 2015

Download Automated Master of Form 16 Part A&B for the Financial Year 2014-15 with all up dated Tax Slab and Tax Section as per the Finance Budget 2014-15 [ This Excel Utility can prepare at a time 100 employees Form 16 Part A&B for F.Y.2014-15]

First time individual home buyers

can get tax deduction on interest of home loan, under newly inserted section

80EE of the Income Tax Act, applicable from the assessment year 2014-15 and On-words A.Y. This is in

addition to tax rebate on interest payment of home loan, under section 24.

Eligibility

for 80EE rebate

This rebate on home loan interest

is applicable only for home loans satisfying the following conditions:

i. Loan is sanctioned by a

financial institution or housing finance company between 1st April 2013

and 31st March 2014.

ii. Loan amount is Rs 25 lakhs

or less and cost of residential house is Rs 40 lakhs or less.

This should be the only house owned

by the taxpayer at the time of sanction.

Maximum

deduction limit under 80EE

Up to Rs 1 lakh can be claimed

towards interest payable on home loan from the financial year 2013-14 and on words F.Y. If

interest payable in this year is less than Rs 1 lakh then the balance can be

claimed in the following year.

For instance if interest payable in

FY 2013-14 is Rs 75,000 then tax rebate on remaining Rs 25,000 can be claimed

in FY 2014-15.

The amount claimed under 80EE

cannot be claimed for tax rebate under any other sections in any year.

How to get

80EE tax benefit

You can either produce certificate from your lender to the HR and get

deduction on salary TDS or you can deduct the amount from total income while

filing income tax return.

Tuesday, 23 September 2014

First time individual home buyers

can get tax deduction on interest of home loan, under newly inserted section

80EE of the Income Tax Act, applicable for assessment year 2014-15. This is in

addition to tax rebate on interest payment of home loan, under section 24.

Eligibility for 80EE rebate

This rebate on home loan interest

is applicable only for home loans satisfying the following conditions:

i. Loan is sanctioned by a

financial institution or housing finance company between 1st April 2013

and 31st March 2014.

ii. Loan amount is Rs 25 lakhs

or less and cost of residential house is Rs 40 lakhs or less

This should be the only house owned

by the taxpayer at the time of sanction.

Maximum deduction limit under 80EE

Up to Rs 1 lakh can be claimed

towards interest payable on home loan in the financial year 2013-14. If

interest payable in this year is less than Rs 1 lakh then the balance can be

claimed in the following year.

For instance if interest payable in

FY 2013-14 is Rs 75,000 then tax rebate on remaining Rs 25,000 can be claimed

in FY 2014-15.

The amount claimed under 80EE

cannot be claimed for tax rebate under any other sections in any year.

How to get 80EE tax benefit

You can either produce certificate from your lender to the HR and get

deduction on salary TDS or you can deduct the amount from total income while

filing income tax return.

Subscribe to:

Posts (Atom)