How to get an HRA tax exemption if you work from home? Advantage of HRA income tax for WFH

For employees, the rental allowance tax exemption (HRA) is a significant advantage. The HRA comes through a portion of the payroll and can be claimed through resident employees.

But in fiscal 2020-21, there are some employees, mostly young people, who live far from the place where they rent and work from home with their parents. But now those same workers are baffled that if they can benefit from HRA even if they live with their parents while working from home, and if they can, how is that possible? The questions are briefly discussed within the article. But first, let us know who is responsible for the HRA and what the calculation method is.

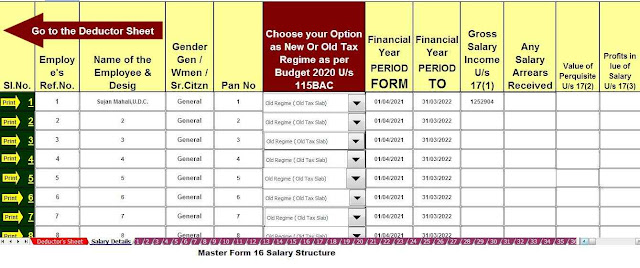

Download Automatic Income Tax Revised Form 16 Part A&B and Part B for the F.Y.2021-22[This Excel Utility can prepare One by One Form 16 Part A&B and Part B]

Who gets HRA and what is the method of calculating it?

HRA is available to employees and provides a portion of the salary. Employees living in rent should be entitled to full or partial tax relief on the amount received from HRA. But workers living in rent are not exempt from the tax and workers are required to pay the full amount of the tax to HRA. one of the circumstances must be necessary to qualify for the HRA benefit.

You can take advantage of the HRA tax credit when an employee submits the rent. This shows that the HRA tax benefit cannot be used if the rent is not presented.

Home rental allowance (HRA) calculation

The tax credit in lieu of HRA is available on the lesser of the following amounts:

• Real HRA received through an employee

• 50% of the salary (base + DA) for employees residing in metropolitan areas. And 40% base + DA for non-metropolitan employees.

• Real rent with furniture minus 10% of the salary (Base + DA)

Download Automatic Income Tax House Rent Exemption Calculator U/s 10(13A) in Excel

For employees who live with their parents while working from home, there is no HRA tax credit if they have not paid their rent. But this benefit must be claimed through the people who presented the rent to the parents.

No HRA benefits unless the rent is registered

If someone has filed for rent with their guardians, they must appear as rental income on their tax return. Their lease must be implemented and presented as proof of payment.

The submission period is currently active for the fiscal year 2020-21, however, the latest extension is until December 31, 2021.

Download and prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22 in Excel