Is Sec 87A Tax Rebate Accessible under New Tax Regime? With Automated Income Tax Revised Form 16 F.Y. 2020-21

According to the Finance Bill 2019, the threshold furthest reaches of tax rebate U/s 87A was reconsidered to Rs 12,500 for F.Y 2019-20. This tax rebate has been made relevant if a person's (Resident People including Senior Residents) taxable income does not exceed or equivalent to Rs 5 Lakhs.

The Finance Bill 2020 (F.Y 2020-21) has kept this Sec 87A tax rebate unaltered for Evaluation Year 2021-22 also.

In any case, there is some disarray among the tax assessees with respect to whether Section 87A is accessible under both old and new tax regimes?

The Finance Bill 2020 introduced a new tax regime, offers a discretionary lower rate of income tax to people with slab rates of 15% and 25% notwithstanding the 10%, 20% and 30% slab rates.

People picking to pay tax under the new proposed lower personal income tax regime should do without practically all tax breaks that you have been asserting in the old tax structure.

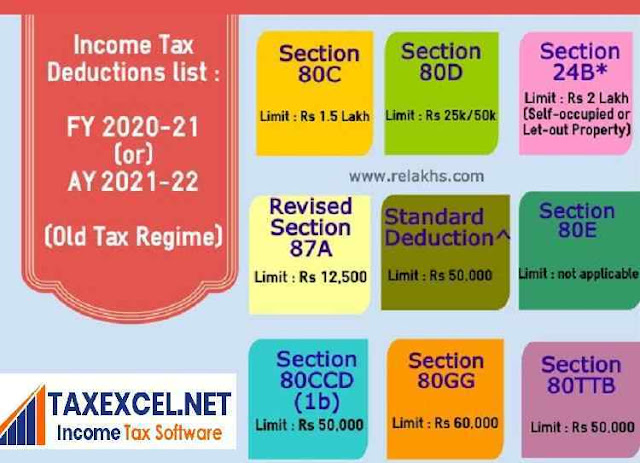

In this regard, all derivations under the section. Through (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, and so forth) won't be claimable by those choosing the new tax regime.

In any case, shouldn't something be said about the Income Tax Rebate of Rs 12,500 U/s 87A? Would you be able to guarantee Sec 87A rebate under new tax regime for A.Y 2021-22?

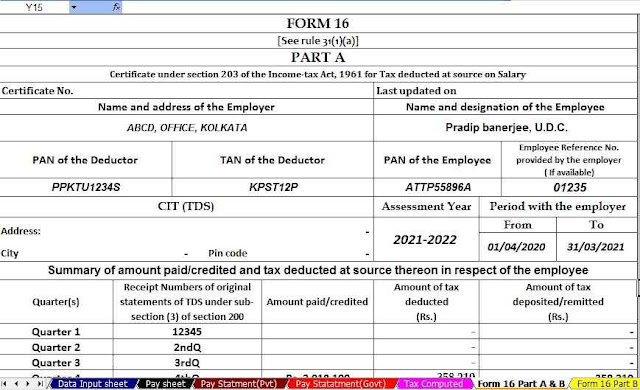

Download Automated Income Tax Revised Form 16 Part A&B for the F.Y. 2020-21 [This Excel Utility can prepare at time 50 Employees Form 16 Part A&B] (Who Are not abele to download Form 16 Part B from the TRACES PORTAL)

We should now first understand what is the importance of Tax Rebate?

What is a Tax Rebate?

Tax rebate is an exemption on taxes when the risk on tax is not exactly the tax paid or obligated to pay, by the individual is alluded to as Income Tax Rebate.

Income Tax Rebate Versus Tax Exception Versus Tax Allowance

Tax Rebate versus Tax Exclusion versus Tax Derivation | F.Y 2020-21/A.Y 2021-22

• Income Tax Exceptions are permitted to be guaranteed from a particular type of revenue (ex: Compensation) and not from the Gross All out Income. Exemption of HRA

• Income Tax Derivations are permitted to be asserted under each Head and furthermore from Net Absolute Income. The taxpayer can guarantee derivations in the event that he/she incurs indicated consumption or make determined ventures under different sections of the IT Demonstration. Models: Speculations u/s 80C (or) Medical coverage expense u/s 80D.

• Whereas, Income Tax Rebate is permitted to be asserted from the complete tax payable. Thus, the exceptions and derivations are permitted to be asserted from the Income and Rebate is permitted from the tax payable.

Treatment and Appropriateness of Rebate under Section 87A AY 2021-22

Since you understand what precisely is tax rebate, how about we leap to our 'primary subject' with regards to whether you can guarantee Sec 87A Rebate of Rs 12,500 under both old and new tax regimes?

The appropriate response is, YES. Section 87A Tax rebate is accessible under both new and old tax regimes for FY 2020-21/AY 2021-22

People having taxable income of up to Rs 5 lakh will be qualified for tax rebate under section 87A of up to Rs 12,500, along these lines making zero tax payable in the Old and New Tax regimes.

Download Automated Income Tax Revised Form 16 Part A&B for the F.Y. 2020-21 [This Excel Utility can prepare at time 100 Employees Form 16 Part A&B] (Who Are not able to download Form 16 Part B from the TRACES PORTAL)

Qualification of Rebate U/S 87A Breaking point FY 2020-21

As far as possible us/87A is Rs 12,500 for FY 2020-21/AY 2021-22. This implies that in the event that the complete tax payable is lower than Rs 12,500, at that point that sum will be the rebate under section 87A. This rebate is applied to the all out tax prior to adding the Training Cess (4%).

• Only Individual Surveys acquiring net taxable income up to Rs 5 lakhs are qualified to appreciate tax rebate u/s 87A.

• For Model: Assume your yearly compensation comes to Rs 6,50,000 and you guarantee Rs 1,50,000 u/s 80C (accessible under old tax regime). The all out overall gain for your situation comes to Rs 5,00,000 which makes you qualified to guarantee a tax rebate of Rs 12,500.

• The measure of tax rebate u/s 87A is confined to a limit of Rs 12,500. In the event that the figured tax payable is not as much as Rs 12,500, state Rs 10,000 the tax rebate will be restricted to that lower sum, for example, Rs 10,000 in particular.

• The Tax Assessee is first needed to add all incomes for example compensation, house income, capital additions, business or calling income and income from different sources and afterwards deduct the qualified tax allowance sums u/s 80C to 80U and under section 24(b) (Home Advance Interest) to think of the net taxable income. (In the event that you choose new tax regime, at that point, you can not guarantee income tax derivations u/s 80c, 80d and so on,)

• If the above net taxable income turns out to be not as much as Rs 5 lakhs then the tax rebate of Rs 12,500 comes into the image and ought to be deducted from the determined absolute income tax payable (according to the income tax slab rates appropriate under old or new tax regimes).

Taxable Income (Rs.) Rebate u/s 87A

Rs. 3, 00,000/ - 2500/ -

Rs. 3, 50,000/ - 5000/ -

Rs. 4, 00,000/ - 7500/ -

Rs. 5, 00,000/ - 12500/ -

Rs. 5, 00,100/ - Nil

Download Automated Income Tax Revised Form 16 Part A&B for the F.Y. 2020-21 [This Excel Utility can prepare at time 50 Employees Form 16 Part B]

No comments:

Post a Comment