Section 80EEA Exemption for interest on home loan with Automated Income Tax Revised Form 16 for F.Y.2020-21

Section 80EEA has been introduced in the July Budget 2019 with the goal of “housing for all”.the Government increased the benefit for the financial year 2019-20.

The main purpose of introducing the department is to provide affordable housing finance for every class of common people and to enable the home buyer to keep low cost funds.

In this article, you will find all the features and benefits of this section for Indian Economy.

Section 80EEA - Before reading the points

Landing U/s80EEA comes with some conditions to get the full benefit of affordable housing finance.

• Loans were taken from a financial institution or a housing finance company to buy the residential home property between 1 April 2019, 312020 and 1 April 2019.

• Only the first time home buyer or applicant has never applied for a home loan or has no residential home in his / her name can avail the benefits of this department

• The actual value of the house (value of stamp duty) should be 45 lakhs or less.

Bengal Applicant if applicable for carpet area of Bangalore, Chennai, Delhi National Capital Region (Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad limited), Hyderabad, Kolkata and the entire city of Mumbai (entire Mumbai metropolitan area)

• Not much, the carpet area of a non-metropolitan city must not exceed 970 square feet.

Earlier you could save up to Rs 2 lakh on interest on home loan for 24 years.

If you are able to meet the requirements of both Section 24 and Section 80EEA of the Income Tax Act, you can claim benefits under both sections.

Section 80EE for F.Y 2018-19 or A.Y 2019-20

For the F.Y2017-2018 or A.Y 2018-2019, first time home buyers can claim an additional tax deduction of up to Rs 50,000 on u / s 80EE in case of interest on a home loan. The following criteria must be met in order to claim a tax deduction under section80EE.

Home Loan FY 2011-17-1. Should have been approved during / after.

Amount should be less than Rs 35 lakh.

House value of the house should not exceed Rs 50 lakhs and

Buy the home a buyer should not have any other existing residential home in his name.

Deduction under Section 24 and Section 80EE / 80EEA, the only difference is your possession, Section 80EE / 80EEA does not require possession of your home.

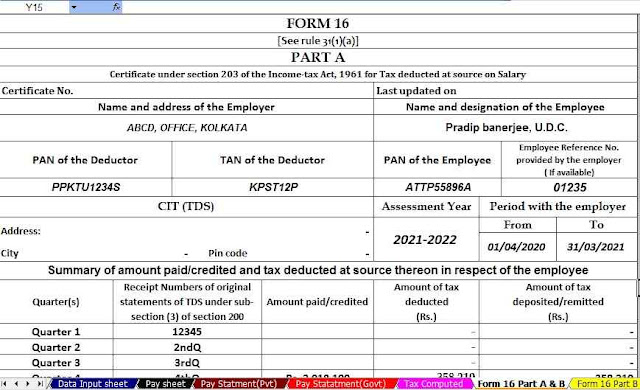

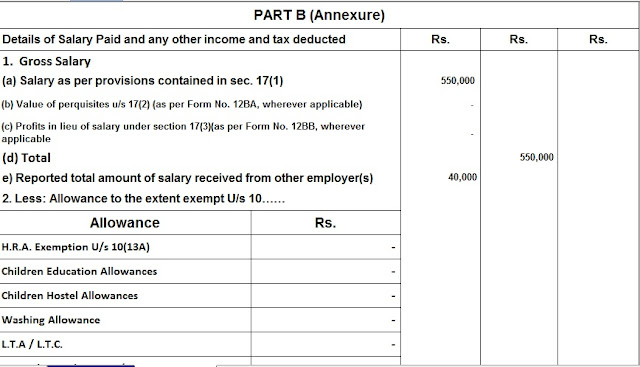

Download Automated Income Tax Revised Form 16 Part A&B and Part B for the Financial Year 2020-21 with new and old tax regime U/s 115 BAC [This Excel Utility Prepare One by One Form 16 Part A&B and Part B]

Income tax benefits on home loans

The first income tax benefit on a home loan can be claimed in three parts. The home loan consists of the principal amount and the amount of interest and the EMI is calculated under a specific home loan calculation formula, resulting in higher interest payments and lower prince payments in the early stages and in the middle of your tenure You will have to repay the principal with interest ratio and below.

Section 80C - Home Principal o Main Payment

How much principal you have paid is clearly stated in the statement of your home principal account, you need to use section 80, which allows you to pay tax deduction up to Rs 1.5 lakh (maximum) for your principal payment.

Section 24 - Home Interest Payment of Interest

Payment of interest on house interest up to Rs. 2 lakhs has been exempted under Income Tax Act 24 / B.

Section 80EE - Paying interest on additional homeowners

This section was introduced by 80EE first time buyers to take a home loan for the first time, first time home buyers can claim additional tax exemption up to Rs.1.5 lakh.

Download Automated Income Tax Revised Form 16 Part A&B for the Financial Year 2020-21 with new and old tax regime U/s 115 BAC [This Excel Utility Prepare One by One Form 16 Part Part B]

There are certain criteria for meeting benefits under this section.

Section 80EE introduced from the financial year 2016-17, divided by any 2016 except 2016-17.

The amount must be less than 35 lakhs.

Home The value of the house is not more than Rs 50 lakh.

Home Lawn applicants never occupy any other residential home in their own name.

New Section 80EEA for F.Y2019-201 F [Y.E 2020-21]

This section overlaps the 80s and by introducing this section, the interest payment discount limit has been increased to Rs 1.5 lakh.

This tax benefit will be available from 1 April 2020 (F.Y 2020-21) and until the expiry of the home loan.

Download Automated Income Tax Revised Form 16 Part A&B for the Financial Year 2020-21 with new and old tax regime U/s 115 BAC [This Excel Utility Prepare at a time 100 Employees Form 16 Part A&B]

Section 24 vs. Section 80EEA

While both categories are available to the taxpayer for home interest payments, there are a few minor differences that you must be aware of:

If the applicant is living with the family property or its vacant space or leaving it for rent - in all cases, deduction of up to Rs 2 lakh is applicable.

Friends also allows you to deduct up to 24 years of age from friends and relatives and the interest paid by them, in the case of Section 80 EEA, only home loans from banks and approved financial institutions.

In order for you to claim 24/24, you must have possession of your home, on the other hand, Sections 80EE and 80EEA allow you to claim a discount as soon as you start paying the interest you need, without imposing any possession requirement.

Only a few loans borrowers can get 100 unfit from this category, as there are many hurdles involved. I recommend reading and understanding this section thoroughly and calculating income tax returns for F.Y 2019-2020 [A.Y 2020-2021].

Download Automated Income Tax Revised Form16 Part B for the Financial Year 2020-21 with new and old tax regime U/s 115BAC [This Excel Utility Prepare at a time 50 Employees Form 16 Part B]

No comments:

Post a Comment