Budget 2021 Key Highlights| with Automated Master of Form 16 Part B for F/Y 2020-21

Budget 2021 Key highlights. The Finance Minister of India has presented the Union General Budget 2021-22 in Parliament today. Please note that there has been no change in the personal income tax structure.

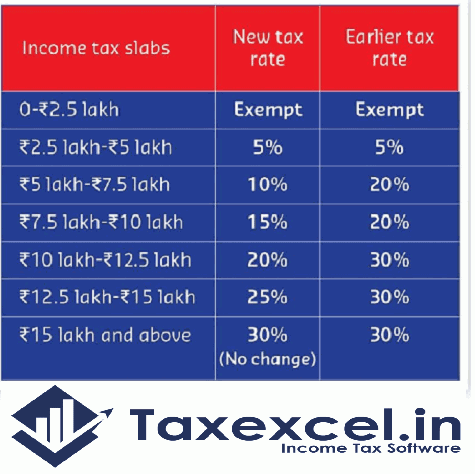

Effective from the fiscal year 2020-21, individual tax assessors have the option of availing new tax slab rates by carrying existing income tax exemptions and concessions such as HRA, Section 80C, home loan tax facility, etc.

Thus, in order to take the new tariff measures below the new tax, the taxpayers will have to waive the income tax exemption.

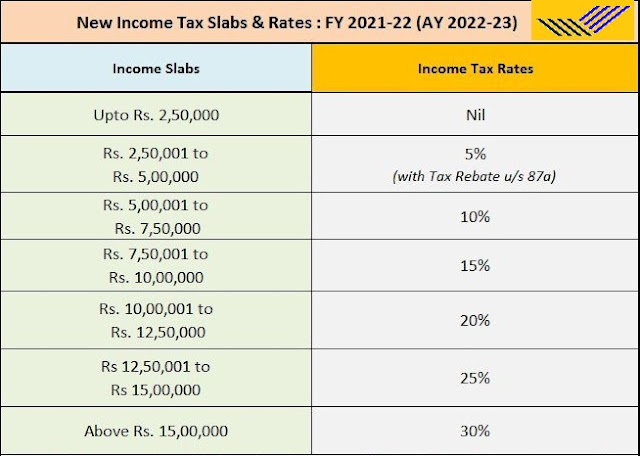

The same income tax slab (new) structure will continue in F.Y 2021-22.

People who are reluctant to pay taxes under the new lower personal income tax will have to cancel almost all the tax breaks that you are claiming in the old tax structure.

Thus, all exemptions (IB, 80-IBA, etc.) under Chapter VIA will not be claimed by those who pray for the new tax discipline.

If you want to claim your own IT exemption and exemption, your income will be taxable according to the existing (FY 2019-20) income tax slab rate (as below);

2021-22 Budget and Personal Finance: Key Highlights

Below are the latest personal finance proposals in Budget 2021-22;

Elderly citizens aged 75 years and above who have only bank/post office pension and interest income are not required to file an income tax return. Although banks will waive the applicable duty. The conditions for exemption from filing ITR from April 1, 2021, are:

o The senior citizen should be a resident and be 75 years of age or older in the financial year for which tax is payable

o He must earn a pension and interest income from the same bank.

o Only certain banks are allowed for this purpose.

o An announcement has to be made to the bank in this regard.

An additional income tax exemption of Rs 2.5 lakh on Able Affordable Loans will be extended for one more year, u / s 80EEA. An interest rebate of Rs 1.5 lakh (Sec 80EEA) will be increased for the loan taken till March 31, 2022. This discount cannot be claimed if you choose a new tax slab.

Cap capital gains (long term and short term), dividend income and interest income details pre-filled in income tax return forms.

• Employee contributions (e.g. EPF / Supervision) not paid by the employer will not be allowed a tax deduction for the employer.

Tax Income Tax Appeal Tribunal to be faceless - only electronic communication will be done.

RIIT and invitees will not impose any TDS on dividend payment. However, this national income is still a taxable income.

Some rules and guidelines will be enacted to change the rules of double taxation and remove the income tax burden of NRIs, especially those returning to India.

Protection to protect investors, investor charters should be introduced as a right of all financial investors across all financial products.

For EPF / VPF (Employee Contribution only) no more than Rs. 2.5 Lack

o If the contribution of the employees is more than Rs. 2.5 Lack

An example - if the employee shares, EPF VPF FY 2021-22, Rs.4.5 Lack is an additional Rs.2 lakh rupees (Rs.4.5 Lack – Rs.2.5 Lack) interest earned will now be taxable.

If the annual premium of ULIP is more than Rs.2.5 Lack, then maturity is no longer duty-free. (New ULIPs have been purchased from February 21, 2021, however, the death benefit is tax-free)

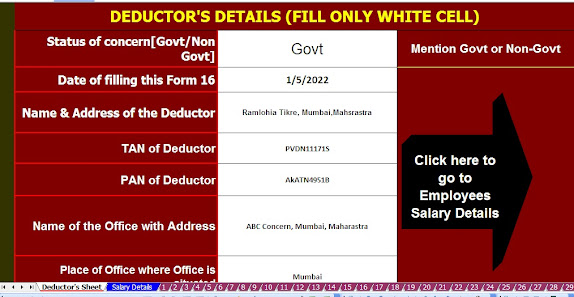

Main Feature of this Excel Utility Are-

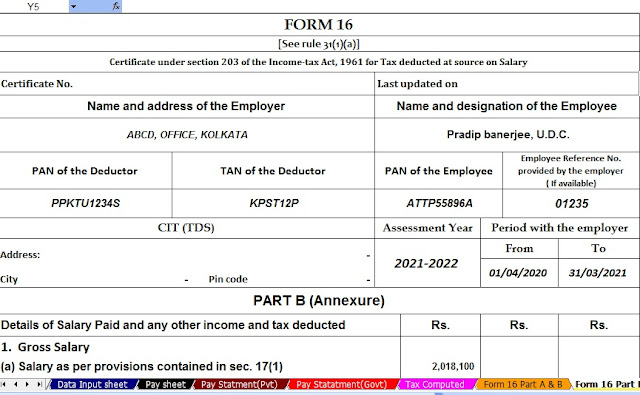

# This Excel Utility can prepare at a time 50 Employees Form 16 Part B as per the New and Old tax regime U/s 115 BAC

# This Excel Utility have all Income Tax Sections as per the Budget 2020

# This Excel Utility can prevent the double entry of employee’s Pan Number

# Easy to install and easy to generate just like an Excel File

No comments:

Post a Comment