Tax Exemption 2021| With Automated income Tax Form 16 for the F.Y.2020-21

Tax Exemptions with Tax, arranging is a significant piece of a monetary arrangement. Regardless of whether you are a salaried individual, an expert or a finance manager, you can save taxes somewhat through legitimate tax arranging.

The Indian Income Tax act takes into account certain Tax Deductions and Tax Exemptions that can be claimed to save tax. You can subtract tax deductions from your Gross Income and your taxable income gets decreased to that degree.

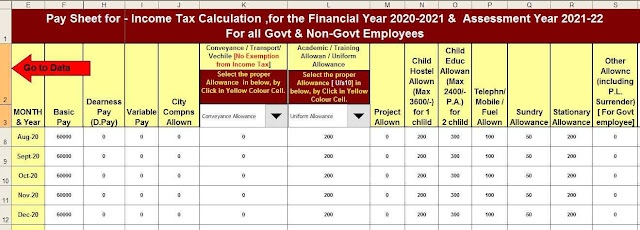

You may also, Like- Automated Income Tax Preparation Excel Based Software All in One for the Govt and Private Employees for the F.Y.2020-21 as per New and old tax regime U/s 115 BAC[This Excel utility can prepare at a time Tax Computed Sheet + Individual Salary Structure for Govt & Private Employees Salary Pattern + Auto Calculate Arrears Relief Calculator U/s 89(1) with Form 10E + Automated Form 16 Part A&B and Part B]

We frequently notice that terms like Income Tax Exemption, Tax Deduction and Income Tax Rebate is utilized reciprocally. Is it accurate to say that they are all very similar? What are the vital contrasts between Income Tax Exemption Vs Tax Deduction Vs Tax Rebate?

How to explain the Income Tax Exemption, Tax Deductions and Tax Rebate?

All these three assistance cut down your tax outgo however are unique in relation to one another. How about we examine: -

What are Income Tax Exemptions?

The exemption signifies 'avoidance'. Income Tax Exemption basically implies the income which isn't liable to tax. Tax exemptions can likewise be those things that are allowed to be claimed from a particular source (Head) of income and not from your complete income.

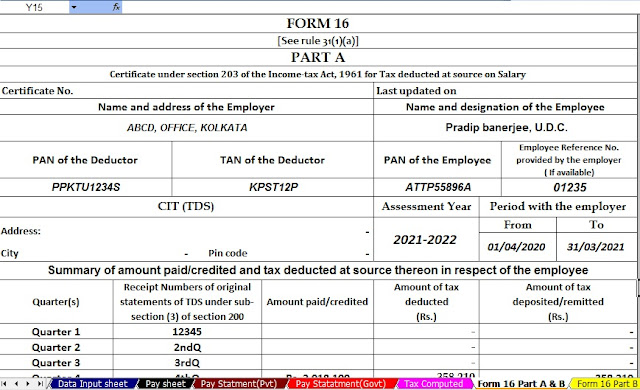

You may also, like-Automated Income Tax Revised Form 16 Part A&B and Part B for the F.Y.2020-21[This Excel Utility can prepare One by One Form 16 Part A&B and Part B as per New and Old Tax Regime]

Various Sources of Income can be - Salary income, Business Income, Income from your House Property, Capital Gains and so forth,

In this way, a tax exemption can be claimed from a specific income class as it were. Models are;

• House Rent Allowance - You can guarantee tax exemption of HRA from your Salary income.

• Gratuity cut off of up to Rs 20 lakh.

• Agricultural income is a tax-excluded income.

• Dividend the income of up to Rs 10 lakh is a tax-excluded income.

Section 54 of the IT Act: Long Term Capital Gain exemption on the offer of Property.

You may also, like-Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21[This Excel Utility can prepare One by One Form 16 Part B as per New and Old Tax Regime]

What are Income Tax Deductions?

Allowance signifies 'subtraction' for example a sum that is qualified to lessen taxable income. Tax deductions are the ones that bring down an individual's tax responsibility by bringing down his/her taxable income.

Income Tax Deductions are allowed to be claimed under each Head and furthermore from Gross Total Income. The taxpayer can guarantee deductions in the event that he/she brings about indicated use or make determined investments under different sections of the IT Act. Models are;

Investments in ELSS Tax saving common asset units, PPF, Life protection plans, EPF and so on, u/s 80c.

• Health Insurance expense u/s 80D.

• Standard Deduction of up to Rs 50,000 (from the F.Y 218-19) from your Salary Income.

• Tax Benefit/relief on Home Loan for the instalment of Interest is allowed as a derivation under Section 24 of the Income Tax Act.

You may also, like-Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21[This Excel Utility can prepare at a time 50 Employees Form 16 Part B as per New and Old Tax Regime]

What is the Income Tax Rebate?

Income Tax Rebate is allowed to be claimed from the absolute tax payable. The exemptions and deductions are first allowed to be claimed from your Income and the Rebate are then deducted from the tax payable. Models are;

• The Tax Rebate Rs 12,500 U/s 87A from the F.Y 2019-20/AY 2020-21.

(It is for the most part was given to diminish the tax weight of people who fall under the lower-income section.)

• Similarly, there is a rebate allowed under Section 89 on receipts of unfulfilled obligations of SALARY.

A great many people confound income tax rebate with income tax relief. The distinction between the two is: tax relief is an allowance from the all-out income to determine your chargeable income, while tax rebate is deducted from the actual taxed sum.

While ascertaining tax obligation, excluded incomes are the principal parts that get decreased from your compensation or other income. You can guarantee tax deductions by making investments in determining items or by causing certain costs under various income tax sections.

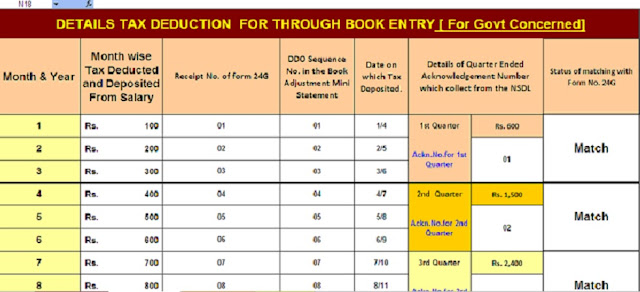

Download Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21[This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B as per New and Old Tax Regime]

No comments:

Post a Comment