Income Tax Preparation Software All in one for the Government & Non-Government Employees for the F.Y.2023-24 & A.Y.2024-25| With Union Budget 2023

Union Budget 2023| Now a person with an income of Rs 15,000 will have to pay only Rs 1.5 or 10 %

of their income.

The Union Budget 2023-24, introduced by Finance Minister Nirmala Sitharaman on February 1, proposed to increase the tax deduction to Rs 7 lakh from the current Rs 5 lakh as part of a package of changes in the form in which the government taxes the salaried class.

If any person who has an annual income of Rs 9,000 will need to pay only Rs 45,000. This is only 5 %of his income. It is a 25 % reduction on the amount to be paid now, i.e. Rs 60,000,” FM explained. Nirmala Sitharaman in the budget letter.

You may also like:- Master of Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24[This Excel Utility Can Prepare at a time 50 Employees

Form 16 Part B’

Similarly, she added that a person with an income of Rs 15,000 would have to pay only Rs 1.5 lakhs or 10% of their income, which is a 20% reduction of the current liability of Rs 1,87,500./-

Raise the standard deduction

Salaried professionals say the new income tax rates for 2023-2024 are a boost for the middle class.

Changes to the standard deduction

The standard deduction benefit has been extended to employees and retirees, including family retirees, under the new tax system.

Salaried people will get a standard deduction of Rs 50,000 and pensioners Rs 15,000 under the proposal. Thus, all the wage earners with an income of Rs 15.5 lakhs or more will receive Rs 52,500 from the above proposals.

The top surcharge rate on personal income tax has been reduced from 37 % to 25% in the new tax regime for income above Rs 2 crore.

This will reduce the maximum personal income tax rate to 39%, which was previously 42.74%. The tax exemption limit on holiday pay at retirement for salaried non-government employees was increased from Rs 3,000 to Rs 25,000.

The new income tax system is a default tax system. However, taxpayers will still have the option to take advantage of the old tax system.

The new tax system does not provide any benefits that taxpayers can take advantage of in any section, including Section 80C - Tax Benefits of Previous Mortgage Loans

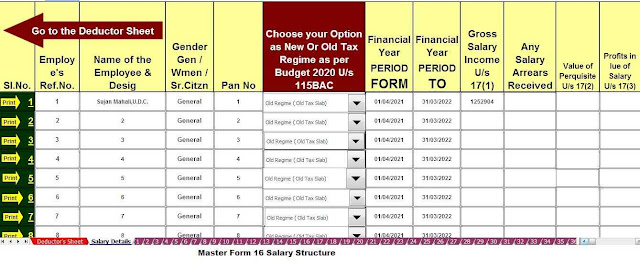

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

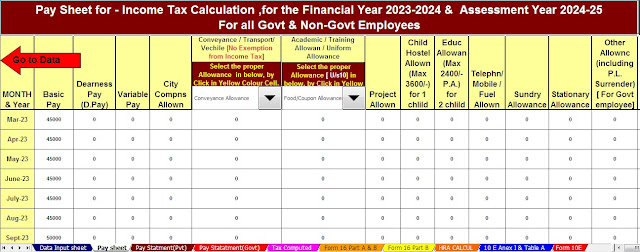

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

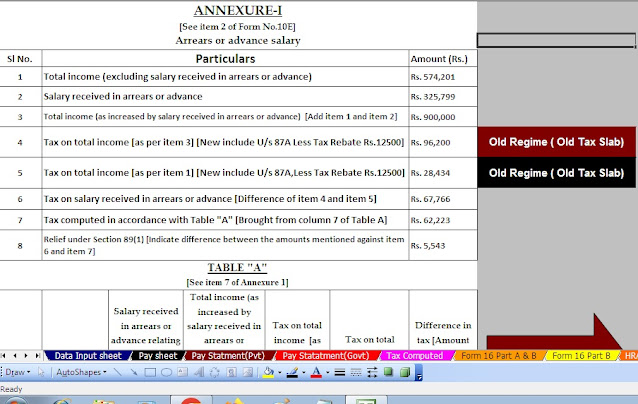

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24

No comments:

Post a Comment