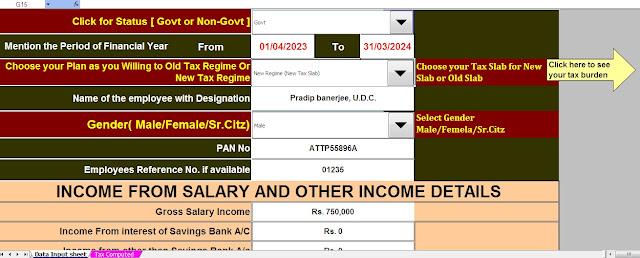

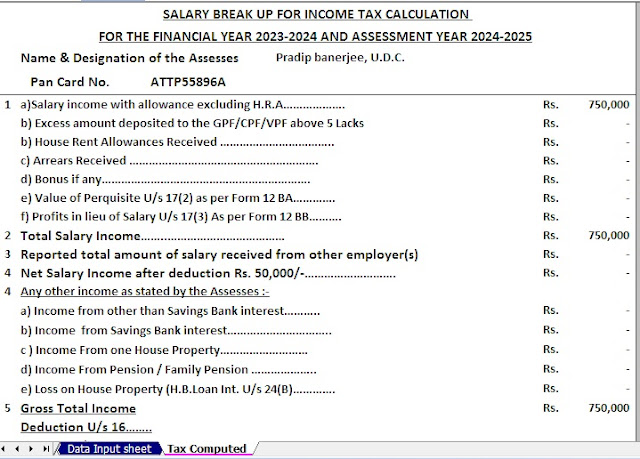

Tax calculator in Excel for Assessment Year 2024-25 with a standard deduction of Rs 50,000, in new and old tax regime as per 2023 budget.

Tax Calculator in Excel for Assessment Year 2024-25. As announced in the Union Budget 2023, the

benefit of the standard deduction for taxpayers has been increased in the new regime. Self-employed

people, pensioners, and family pensioners can now benefit from standard deductions under the new

You may reduce your tax burden to claim deductions Under Section 80C. It allows deductions up to Rs 1.5 lakh for investments in various instruments like Public Provident Fund (PPF), Equity Lied Savings Scheme (ELSS), National Pension System (NPS), Tax-saving Fixed Deposits (FD), and others. Next to the common section to reduce your taxable income is through Section 80D Maximum of Rs. 25000/- for those below 60 Years of Age and Rs. 50,000/- for Senior Citizens.

You may also like:- Automated Income Tax Master of Form 16 Part A and B for the Financial Year 2022-23 and Assessment Year 2023-24[ This

Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

Under Section 16 of the Income Tax Act, of 1961, any salaried employee can take a standard deduction from his taxable income. No documentation or proof of investment needs to be submitted to claim it. Once retired, this standard deduction can also be used. You don’t need to get insurance or show proof of investment for it.

The government of India has changed the standard deduction from time to time to account for inflation. Currently, taxpayers can avail of a standard deduction of up to Rs 50,000. The biggest benefit of this is for those salaried employees who come in the category of taxable income only for a margin of Rs 50,000.

Previously, the conventional tax relief benefit was only available to those who opted for the old tax regime. However, after the Union Budget 2023, this benefit has also been extended to those who opt for the new tax system. Whichever tax regime you choose, you are entitled to a standard tax deduction of Rs 50,000.

No comments:

Post a Comment