While under the old taxregime the salaried people can keep covering taxes, as they had been doing work now; under the new regime, they will be obligated to settle lower taxes, if they forego their deductions and exemptions.

New Tax plan 2020 has given taxpayers a choice to proceed with the current tax regime or select the new proposed tax regime. Although today are tangled concerning which regime they should choose an option (in the new prescribed Form 10-IE) and why? While under the old tax regime the salaried people can keep settling taxes, as they had been doing work now; under the new regime, they will be subject to make good on lower taxes, if they forego their deductions and exemptions.

As per the New Income Tax Section 115 BAC introduced in Budget 2020. As per the Section 115 BAC you should give your option as you opt-in as New Tax Regime or Old Tax Regime in the newly prescribed Form 10-IE.

If you choose the New Tax Regime you can not avail any exemption U/s 80 C, Chapter VI-A But if you choose the Old Tax Regime then you can avail all the Exemption as per the Income Tax Act 1961.

You may also like this Excel Utility.

The difference between the two tax regimes

Deductions/Exemptions

Principle exemptions that taxpayers should forego on the off chance that they choose the new regime are Standard Deduction of Rs. 50,000 to salaried taxpayers, House Rent Allowances for people remaining in leased convenience, Interest on lodging advance for a self-involved property, Leave Travel Stipend twice in a square of four years, the most ordinarily asserted derivation under section 80C for fortunate asset commitment, life coverage L.I.C. Premium, Educational Allowances for youngsters, ELSS, PPF and so on

You may also like this Excel Utility.

Nothing unless other options can be guaranteed under the new tax regime. An aggregate of 70 exemptions has been discarded in the new tax regime.

On the off chance that your taxable pay is under 5 lakhs or over 15 lakhs, at that point tax rates are the same in both; thus the older regime that permits exemptions is more fit

Out of the multitude of exemptions that have been taken out, check the number of is relevant for you and how much cash you can spare by settling on those. This will help you in the subsequent stage.

Because of your net taxable pay post exemptions/deductions, ascertain all-out annual tax under old just as a new regime.

Aside from taxable pay, your way of life, life stage, short-and long haul needs alongside monetary objectives are magnificent boundaries to choose what kind of tax regime you ought to settle on. With the expansion, rising commercialization and developing necessities, it's critical to begin sparing early and spend shrewdly. The intensity of compounding has an incredible task to carry out in accomplishing your monetary objectives.

You may also like this Excel Utility.

Note:- that it is conceivable to change tax regimes each monetary year, as both will exist at the same time. First – time taxpayers may choose to pick the new tax regime as it's easy to follow and means lower tax risk. In any case, over the long haul, ventures have monetary advantages and taxpayers will need to go for the old regime as that will be more helpful.

The current tax system declaration has gone the additional mile to give sufficient opportunity for a decision to each salaried person. It's ideal to understand each factor as you come to this agenda before doing the switch. Opportunity is yours, utilization it shrewdly.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

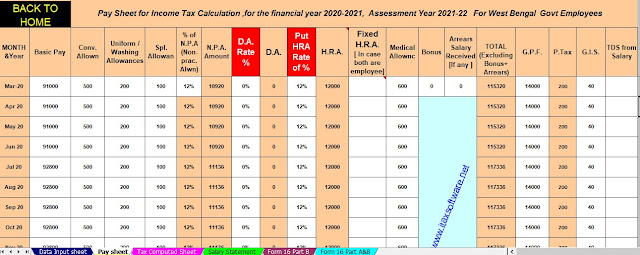

3) This Excel Utility has a unique Salary Structure as per the W.B. State Employee’s Salary Structure.(After ROPA 2019)

4) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

5) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21