Excel Form 10E-Salary Arrears Relief Calculator A.Y 2021-22 to claim an exemption under Section 89 (1) of the Income Tax Act 1961

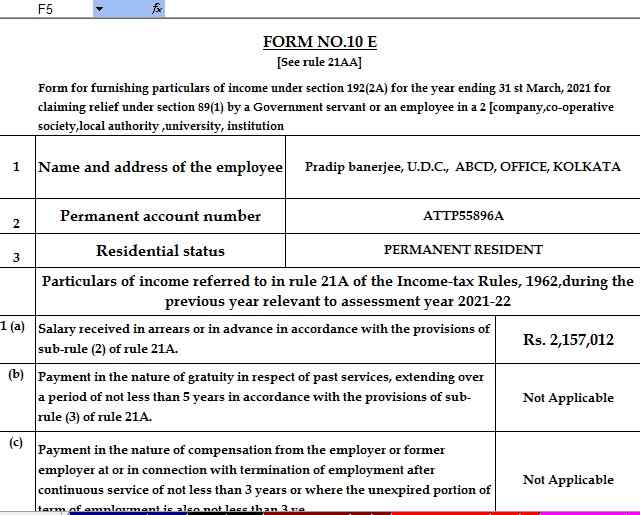

Pursuant to Section 99 (1) of the Income-tax Act, relief is provided for income-tax in the financial year 1961 when an employee receives arrears or advance payment. Pursuant to Rule 21AA of the Income-tax Rules, 1962, Form 10-E is prescribed for claiming relief.

Pursuant to the said rule, while the employee is a government employee or an employee of any the organization, co-operative society, local authority, university, organization or agency, he/she may submit Form 10E to his / her employer for a claim of relief under sub-section 196 of the Income-tax Act, 1961. Responsible for payment of salary mentioned under (1)

In all other cases, the assessee must submit an application as Form 10E to the Income Tax Assessing Officer to claim relief. Relief under section 89 (1) is approved in the assessment year where arrears or advance employees receive in salary revisions have become commonplace, especially in the public sector

Since independence, the government has set up six pay commissions. As a result of arrears of salary as a result of the recommendations of each commission with revocable effect. The rationale behind this relief under section 99 is that due to payment of arrears or advance payments received in the prescribed financial year, the income of the employee for that financial year increases due to the amount of arrears or advance. As a result, in the absence of such arrears or advance progress, the employee's income attracts higher tax collection than his rate.

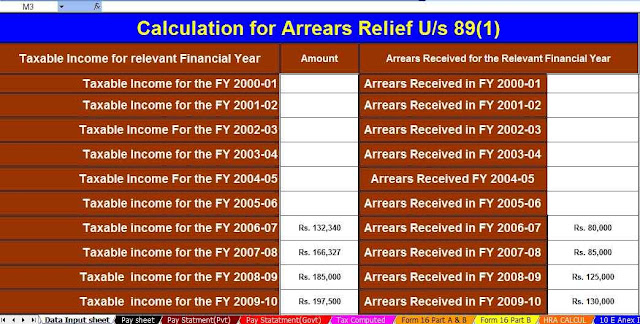

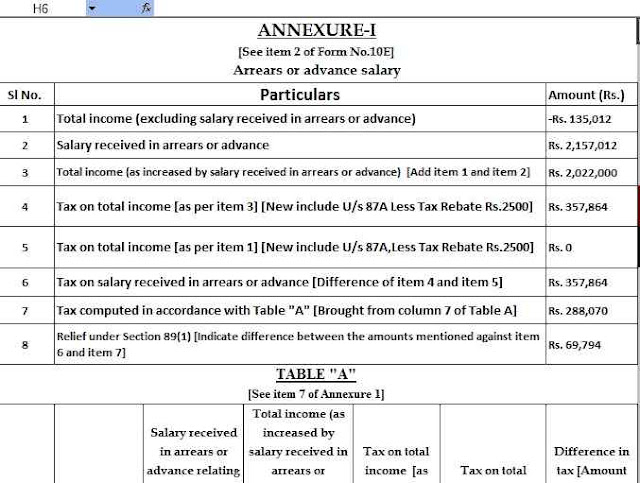

This calculator is a simple, automated and user-friendly utility for making relief work that calls for minimal effort and data input. Users only need to fill in the datasheet and it automatically calculates the relief and prepares attachment-1 in Form 10E, Table-1. For example, built-in instructions and auto checks are provided inside. Macros need to be enabled to use this utility.