Some Tips about New Section 115 BAC

Budget 2020 has introduced a new Section 115 BAC which is a new tax Regime for individual updates and certain procedures and requirements that you need to follow that new tax Regime.

We get to see if you can individual salaried employees for you get started in 2020 in which are reduced however certain conditions allow for the detection of the new tax system.

In the financial year 2020-2021 you need to fill a form which is issued by CBDTform number 10 IE before filing your income tax return and in case of a business that individuals in need the only fill of Form 10 –IE. which is issued by CBDT from 1st October 2020 which is you need to file in addition to it before filing an income tax return is coming to switch over from old to new.

Also you may like

Now we have to divide the category of individuals into parts business income & income from the salary, that means you can switch from old to new every year’s and it means you need to fill the new option Form I0-IE every year.

However,

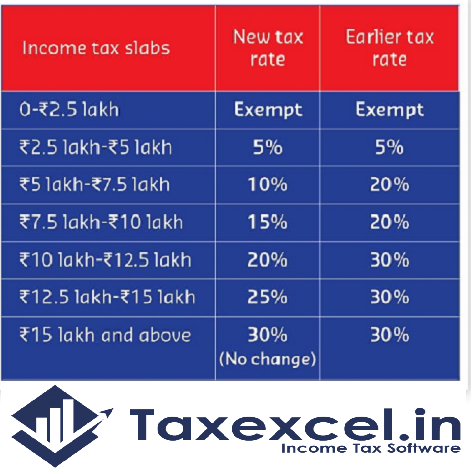

we will see the new tax lab rates that were introduced in budget

2020, and see how you can calculate your

income tax for the financial year of 2020 to 21. There are new tax lab rates

that were introduced in budget 2020,

So as you can see, the new tax lab rates are reduced tax slab rates compared to old tax slab rates, you have the option of choosing which takes neighborhoods, if you are willing to use to calculate your income tax, but there is a condition.

Also you may like

If you need to use new reduced tax rates, you will not have the option of claiming deductions under various sections that would help you to reduce your total income tax. This means, if you need to use reduced tax lab rates, you cannot claim deduction under Section C and Chapter VI-A, which includes investments in provident fund, public provident fund, equity-linked savings schemes, life insurance premiums, and other schemes that fall in this category.

Along with this section, you will not have the option of claiming deductions under other sections as well. But the same deductions can be claimed if you're using the old tax regime, which is higher compared to new tax liabilities.

Another important point to note is if your taxable income is below rupees five lakhs. If you want not to have to pay any income tax. This is possible because of the tax rebate under the section. 87 A.

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2020

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Government and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10) Automatic Convert the amount in to the in-words without any Excel Formula