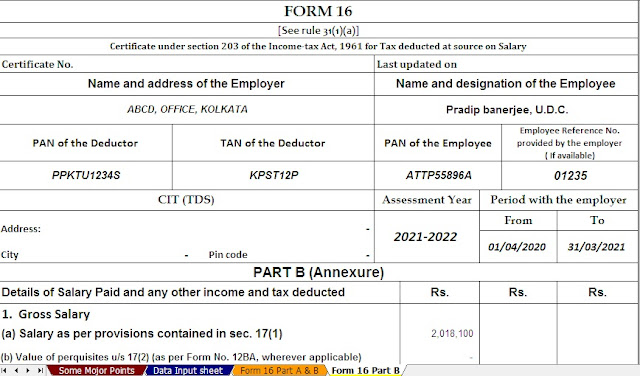

Form 16 is a document or certificate issued to salaried professionals in India by self employers under Section 203 of the Income Tax Act, 1961

It has details of the salary paid to the employee by the employer in the F.Y. and the tax deducted from the salary by the deductor as well as the employer.

TDS deducted by the employer is credited to the income tax department and instead, Form 16 is the proof. Employers must issue Form 16 to their employees on or before June 15 of the financial year that the income was immediately collected and tax deducted.

Eligibility Criteria for Form 16?

Every salaried person under the taxable bracket is eligible for Form 16 is. If an employee does not fall within the prescribed tax brackets, he/she does not have to deduct tax at the source (TDS).

Form 16 the elements of Form 16 are subdivided into the following two parts which include:

Form 16 Part A and

Form 16 Part B

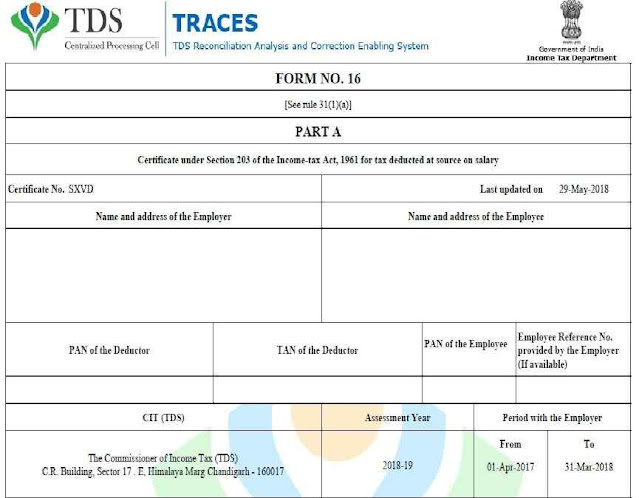

Form 16 Part A

Part A gives the summary of the salary income collected by the employer on behalf of the employee and deposited in the government account. It is a certificate duly signed by the employer which they deducted TDS from the employee's salary and submitted to the income tax department. This Form 16 Part A mandatory to download through the Income Tax TRACES PORTAL.

This Form 16 Part A has the following details:

Employee's as well as employer's information

Individual and employer name, address details,

PAN details of both, and TAN details of the employer.

Evaluation Year (A.Y)

The period for which the individual was employed with the employer in the financial field

Summary of paid salary

Date of tax deduction from salary

Date of submission of tax to government account

Three months Interval the tax deduction and submission to the Income Tax Department

Recognition number of TDS payment

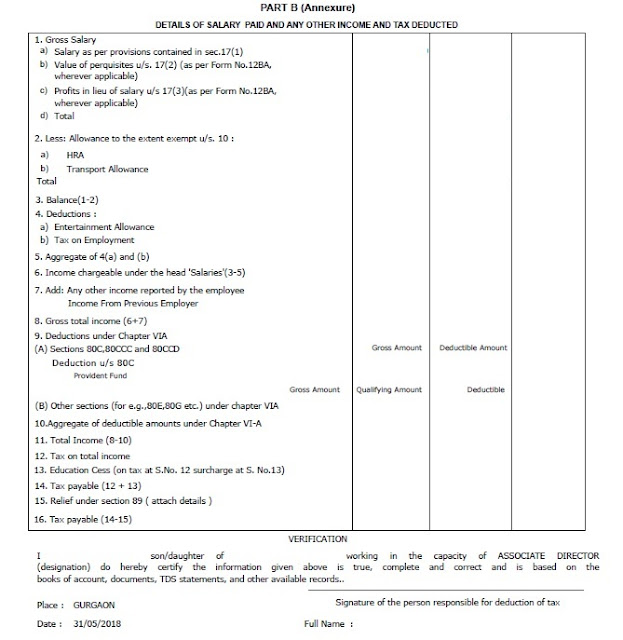

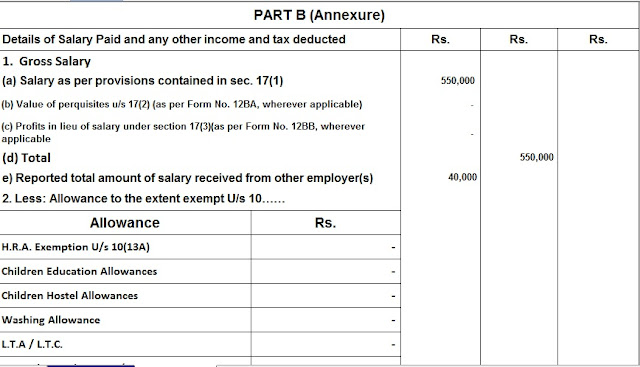

Form 16 Part B is a compilation of details of the salary paid, any other income declared by the employee to his organization, the amount of tax payable, and if any tax payable is paid as an addition to Part B of Form 16, it includes Presents information on applicable discounts as well. The names and details of the employees like PAN are also mentioned in the passage

It contains the following information:

Total salary received

Exempt allowed U/s 10 (5),10 (10), 10 (10A), 10 (10AA), 10 (13A), any other discount amount U/S 10.

The standard exemption is allowed under section 103 of the Income Tax Act.

Income (or perceived loss) from the home property reported by the employee proposed for TDS,

Other sources of income under the head are proposed for TDS.

Fields are available for the amount of total salary received from other employers.

Income Tax deduction from the salary:-

Section 80C / 80CC / 80CCD / 80D / 80E / 80G / 80TTA and other applicable sections are supplied.

All these discount details must be submitted to the employer by the employee along with the required supporting documents.

Net taxable salary

Scholarship fees and surcharges if any. If applicable, exempt under section 87 released under Section 89, if any

The amount of total tax payable on income. Tax-deductible and balance tax applicable or refundable.

Download Form 16

Form 16 Part A Portion downloaded and issued by the employer. No one can download his Form 16 Part A For each employer in a financial year

In the case of people who have changed jobs as well as worked with more than one employer in a particular financial year, they will receive a separate Form 16 from all employers.

The link between Form 16 and Form26AS?

The 26AS form will be submitted with all taxes and deductions from your salary and/or unpaid income to the concerned authorities. Thus, the tax exemption displayed on Form 16 / Form 16A can be cross-checked and verified using Form 26AS. Ideally, the amounts of TDS deducted in Form 26AS and Form 16 A must match. If there is any discrepancy, the Tax Department considers the TDS figures as only 26 forms.