Tuesday, 9 February 2021

Wednesday, 23 December 2020

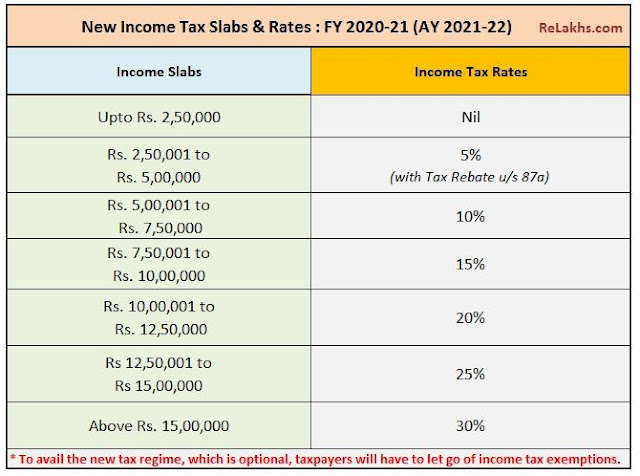

As per the Budget 2020, introduced a New Tax Section 115 BAC, which means that the New Tax Regime and Old Tax Regime as you like you can choose the option Vide the new introduced Form 10-IE in this Budget.

If you choose the New Tax Regime as well as new tax Slab for the financial year 2020-21, you can not availed any income tax exemptions as per the Income Tax Act 1961 except the NPS benefits and have no benefits in the new tax slab rate to the Senior Citizen. But if you choose the Old Tax Regime as well as Old Tax Slab then you can availed the all of benefits of the Income Tax As per the Income Tax Act 1961.Look the below New and Old Tax Slab for the F.Y.2020-21 as per U/s 115BAC.

However here is a unique Excel Based Form 16 Preparation Software, prepared as per the New Section 115 BAC for the Financial Year 2020-21.

Download Automated Income Tax Revised Master of Form 16 Part A&B for the Financial Year 2020-21 with new and old tax regime U/s 115 BAC. [This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

Feature of this Excel Utility:-

1) This Excel Utility Prepare at a time 50 Employees Revised Form 16 Part A & B [Who are not able to download Form 16 Part A from the TRACES PORTAL, they can use this Excel Utility.

2) In this Form 16 Part B have details of all the Income and Deductions as per New and Old Tax Regime

3) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

4) This Excel Utility has the all amended Income Tax Section as per Budget 2020

5) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

6) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

7) Automatic Convert the amount in to the in-words without any Excel Formula