Automated income tax form 16 Part B details for the F.Y.2020-21

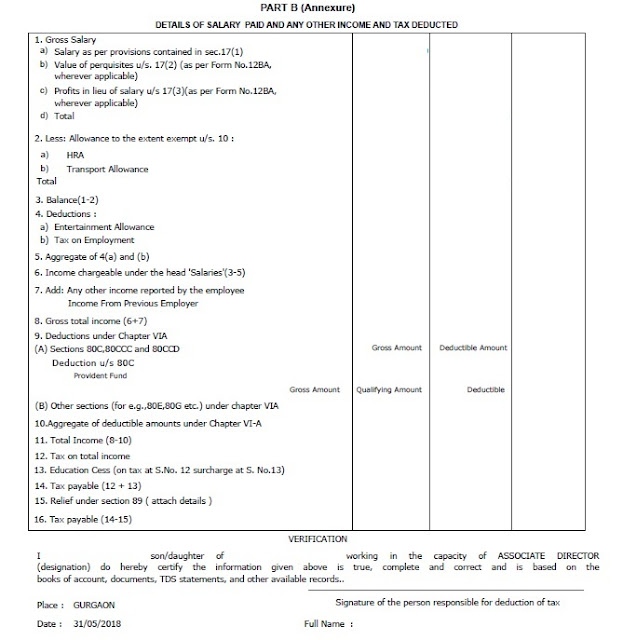

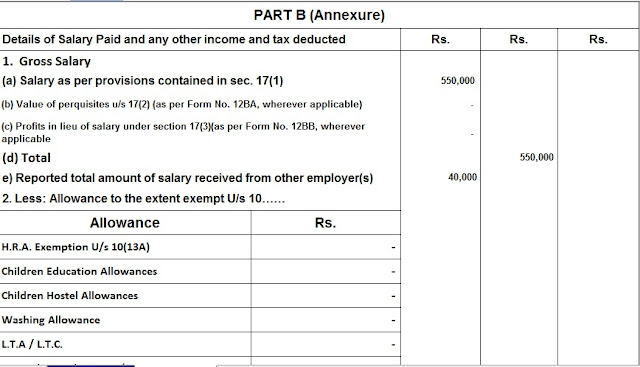

To provide 16 forms to all employees from June of each financial year as per the Income Tax Act and to file income tax returns for the assessment year 2021-22. Form 16 divided into 2 parts, Part A which is generated from the TRACES PORTAL after uploading the TDS Annual Return 24Q or 26Q. And Form 16 Part B is prepared and issued by the employer.

As per Budget 2020, a new Income Tax Department has introduced 115 BAC where you can choose an alternative to new and old tax slabs. These are called new and old tax rules. So you should know about the new and old tariff system: -

1) If you opt for the new tax system as well, you will not be able to avail of any income tax exemption or exemption under the Income Tax Act except for the NPS facility.

But

2) If you choose or opt for the Old Tax Regime you can get all the benefits as per the Income Tax Act and you can get the Old Tax Slab as per the tax slab rate for the financial year 2019-20.

As per notification No. 39-2019, the Income Tax Department has effectively amended Form 16 Part B from 12th May 2019. That notification clearly states that the Income Tax Site TRACES PORTAL and Part 2 of the Compulsory Form 16 Part Form 16 to be downloaded from the 2nd The employer must be prepared by the cutter.

Form 16 Part A only shows employee tax deduction and deposited to Central Government. And another Form 16 Part B will show all the coverage of the employee’s Gross total income of the employee

Features of this utility:

# Automatically calculate taxes

# Bulk Generate Form 16 Part B

# Prevent double-entry of employees' PAN card number automatically

# You can create 16 forms with more than 1000 employees with this One Excel utility.

How to use the Form 16 Part B utility?

Download the utility from the link provided below. This Excel utility has basically 2 sheets for filing employee data. And all other Forms 16 Part B.

Update the initial information details and signer details in the master sheet.

After updating the next master sheet you fill out the employee payroll than all of the bulk forms 16 will be automatically filled in including income tax calculation as per new and old tax slab for F.Y.2020-21.

Print Form 16 Part B

It will be ready for printing when the data-sheet is updated. Now you can open the Form 16 Part B sheet and click the serial number to print the desired employee’s Form 16 Part B/