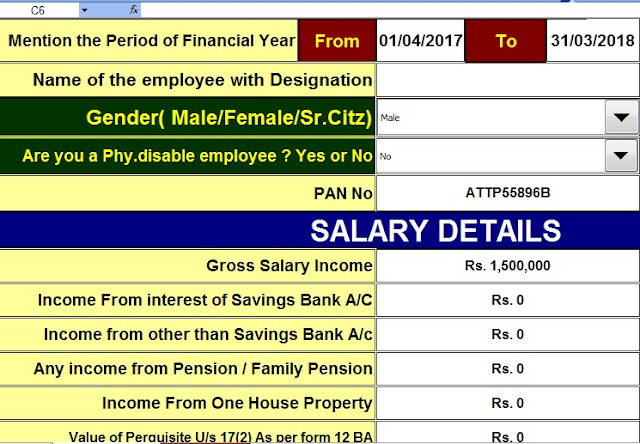

Download Automated Income Tax Preparation Excel Based All in One TDS on Salary for Only Non-Govt Employees for the Financial Year 2017-18 and Assessment Year 2018-19. [ This Excel Based Utility can prepare at a time your Individual Tax computed Sheet + Individual Salary Structure as per the Non-Govt Employees Salary Pattern + Automated H.R.A. Calculation + Automated Form 12 BA + Automated Form 16 Part A&B and Form 16 Part B as per the latest Income Tax Slab.]

Main Data Input Sheet

|

Individual Salary Structure

|

Individual Tax Computed Sheet |

Form 16 Part A&B |

Form 16 Part B

|

As per the Budget, we can only say that the Deductions may be the following because it may get changed in final Budget.:

1. Deduction u/s 80C, 80CCC, 80CCD is Rs. 1,50,000. (80CCC - Deduction for Annuity Plan)

A) Additional Deduction can be entitled U/s 80CCD(2) Out of Max Limit Rs. 1.5 Lah U/s 80C

B) Additional Deduction can entitled U/s 80CCD(1B) Max Rs. 50,000/- out of Max Limit Rs.1.5 Lakh U/s 80C

2. Deduction u/s 80D is Rs. 25000 for general and Rs. 30000 for Senior citizens. (For Mediclaim paid)

3. Deduction u/s 80E here you can take education loan from the financial institution for higher studies and can avail tax deduction for the maximum of 7 years.

4. Deduction u/s 80G - Deduction for donations, here you can get 100% and 50% deduction of the amount paid as a deduction but percentage depends upon the receiver.

5. Deduction u/s 80GG Deduction for House rent paid....

Deduction is least of

A) Rent paid less 10% of total income.

B) Rs. 5000 per month

C) 25% of Total Income.

6. Deduction u/s 80U. Deduction for the person suffering from physical Disability... normal disability deduction of Rs.75000, and severe disability deduction of Rs. 125000.

7. 100% TAX DEDUCTION on contributions made to SWACHH BHARAT & CLEAN GANGA initiatives.

8. Deduction u/s 80DD Expenditure on account of specified diseases Rs.80000.

9. Deduction u/s 80TTA Deduction of Income received from Saving Bank Interest Rs. 10000.Max.

10. Deduction u/s 87A: Tax rebate of Rs.2,500/- who’s taxable Income is less than Rs.3,50000/-

2. Deduction u/s 80D is Rs. 25000 for general and Rs. 30000 for Senior citizens. (For Mediclaim paid)

3. Deduction u/s 80E here you can take education loan from the financial institution for higher studies and can avail tax deduction for the maximum of 7 years.

4. Deduction u/s 80G - Deduction for donations, here you can get 100% and 50% deduction of the amount paid as a deduction but percentage depends upon the receiver.

5. Deduction u/s 80GG Deduction for House rent paid....

Deduction is least of

A) Rent paid less 10% of total income.

B) Rs. 5000 per month

C) 25% of Total Income.

6. Deduction u/s 80U. Deduction for the person suffering from physical Disability... normal disability deduction of Rs.75000, and severe disability deduction of Rs. 125000.

7. 100% TAX DEDUCTION on contributions made to SWACHH BHARAT & CLEAN GANGA initiatives.

8. Deduction u/s 80DD Expenditure on account of specified diseases Rs.80000.

9. Deduction u/s 80TTA Deduction of Income received from Saving Bank Interest Rs. 10000.Max.

10. Deduction u/s 87A: Tax rebate of Rs.2,500/- who’s taxable Income is less than Rs.3,50000/-

Other Related Deductions available u/s 10 of Income Tax:

A. Exemption of transport allowance Rs 19,200 /-P.A & Phy.disable persons can get Rs.38500/- P.A.

B. Tax-free infra bonds proposed for funding irrigation, rail & road infrastructure projects.

C. Income tax exemption on Interest paid on Housing Loan u/s24B of Rs.200000. on a self-occupied property.

D. HRA (House Rent Allowance) Least of HRA paid or Rent paid less 10% of salary or 40% of salary (50% in case of Metro city)

E. Leave Travel Allowance

F. Children Education Allowance Rs.100 per month per child and max 2 children.

G. Hostel Allowance, Allowance Rs.300 per month per child and max 2 children.

H. Deduction u/s 80 EE. Additional House Building Loan Interest up to Rs. 1,00,000/- will be admissible who have paid the HBL Interest w.e.f. 1/4/2013 (Excluding the Section 24 B)

A. Exemption of transport allowance Rs 19,200 /-P.A & Phy.disable persons can get Rs.38500/- P.A.

B. Tax-free infra bonds proposed for funding irrigation, rail & road infrastructure projects.

C. Income tax exemption on Interest paid on Housing Loan u/s24B of Rs.200000. on a self-occupied property.

D. HRA (House Rent Allowance) Least of HRA paid or Rent paid less 10% of salary or 40% of salary (50% in case of Metro city)

E. Leave Travel Allowance

F. Children Education Allowance Rs.100 per month per child and max 2 children.

G. Hostel Allowance, Allowance Rs.300 per month per child and max 2 children.

H. Deduction u/s 80 EE. Additional House Building Loan Interest up to Rs. 1,00,000/- will be admissible who have paid the HBL Interest w.e.f. 1/4/2013 (Excluding the Section 24 B)

I. U/s 80TTA: - Interest of Savings Bank Max Rs. 10,000/-