Arun Jaitley while announcing the Budget 2016 re-introduced Section 80EE which provides for additional Deduction of Rs. 50,000 for Interest on Home Loan. This incentive would be over and above the tax deduction of Rs. 2,00,000 under Section 24 and Rs. 1,50,000 under Section 80C.

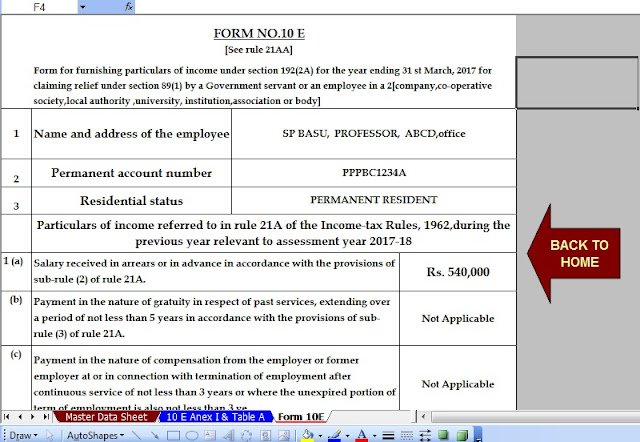

DownloadAll in One Income Tax Preparation Excel Based Software for Govt & Non-GovtEmployees for F.Y. 2016-17 & A.Y.2017-18 [ This Excel Utility can prepare at a time Income Tax Computed Sheet + Individual Salary Structure + Individual Salary Sheet + Automatic Arrears Relief Calculation with Form 10E up to F.Y.2016-17 + Automated H.R.A. Calculation + Automated Form 16 Part A&B and Form 16 Part B ]

This Deduction of Section 80EE would be applicable only in the following cases:-

1. This deduction would be allowed only if the value of the property purchased is less than Rs. 50 Lakhs and the value of loan taken is less than Rs. 35 Lakhs.

2. The loan should be sanctioned between 1st April 2016 and 31st March 2017.

3. The benefit of this deduction would be available until the time the repayment of the loan continues.

4. This Deduction would be available from Financial Year 2016-17 onwards.

The above 3 Sections relating to Tax Benefits on Home Loans have been summarised as under:-

Particulars

|

Quantum of Deduction (Rs.)

| |

Self Occupied Property

|

Non-Self Occupied Property

| |

Section 24

|

2,00,000

|

No Limit

|

Section 80C

|

1,50,000

|

1,50,000

|

Section 80EE

|

50,000

|

50,000

|

Please Note:-

1. The above tax deductions are per person and not per Property. So in case you’ve purchased a property jointly and have taken a joint home loan, each person repaying the amount would be eligible to claim the whole deduction separately.

2. If you are living in a rented premise and are taking Tax Benefit of HRA Allowance, even then you can claim Tax benefit on home loan under Section 24, Section 80EE & Section 80C.

For claiming the above tax deductions, you would be required to furnish the statement provided by the lender clearly indicating the amount payable and paid towards Interest and Principal. After claiming the above deductions of Tax Benefit on Home Loan, the balance Income of an Individual would be taxed as per the Income Tax Slab Rates.