Some top benefits in the income tax |Section 80C - Exemption on Investment

The Customs 80C is one of the most popular and favorite categories among taxpayers, as it allows you to reduce taxable income by investing tax savings or bearing expenses. This allows a maximum deduction of Rs 1.5 lakh per annum from the total income of the taxpayer.

Section 80 TTA - Interest on Savings Accounts

Deduction from total income for interest on the savings bank account

If you are a person or HUF, you can claim a maximum discount of Rs 10,000 from your savings account against interest income through banks, co-operative societies, or post offices. Do not include interest on other income from the savings account.

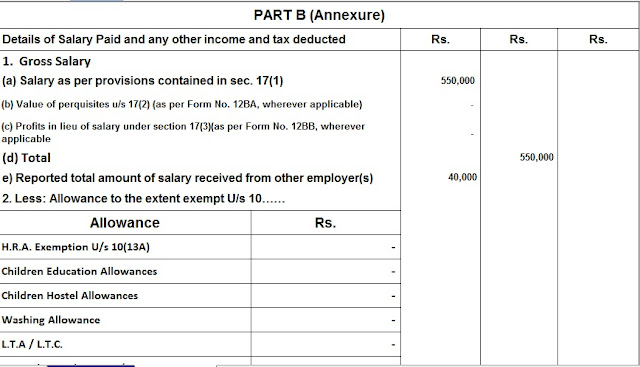

You may also, like- Automated Income Tax Revised Form 16 Part B which can prepare at a time of 50 Employees Form 16 Part B for the F.Y.2020-21

Section 80GG - House rent paid

Discount for home rent payment where HRA is not accepted

A. Available for payment of 80GG discount if HRA is not accepted. Taxpayers, spouses, or minor children should not have residential accommodation at the place of employment

B. The taxpayer should not have self-occupied residential property elsewhere

C. The taxpayer must live between paying rent and rent

d. The discount is available to all individuals

The lowest of the following discounts is available:

A. 10% of the total income paid for rent has been spent

B. 5000 / - per month

C. 25% of total gross income *

Section 80EE - Interest on Home On

Discount on home interest for first-time homeowners

Homeowners (individuals) who have only one home property on the 80th approval date will be eligible for the 80EE section discount. The cost of the property mandatory be less than Rs 50 lakh and the house loan must be less than Rs 35 lakh. Loans from any financial institution must be approved between 1 April 2011 and 31 March 2017. There is an additional rebate of Rs. 50,000 on the interest on your home loan. On top of the rebate of Rs.

201Y-1. The concession received under this section in FY and FY 2019-1 was the first time the house was valued at Rs 4 million or less. You can get it only when your loan amount is Rs 25 lakh or less at this time. April has to be sanctioned between 1st April 2013 to 31st March 2014. The total amount of exemption allowed under this section cannot be more than Rs. 1 lakh and 2011-14-1. And approved for FY 201-1Y.

You may also, like- Automated Income Tax Revised Form 16 Part B which can prepare at a time 100 Employees Form 16 Part B for the F.Y.2020-21

Section 80D - Medical Insurance

Discount on premiums paid for medical insurance

You can claim a rebate of Rs 25,000 under Section 80D on insurance for self, spouse, and dependent children (either individually or as HUF). Additional discounts of up to Rs 25,000 are available for parental insurance under the age of 60. If the parents are over 60 years of age, the amount of this exemption is Rs 50,000, which has been increased from Rs 30,000 in the budget in 2013-14.

Section 80 DD - Disable dependent

Exemption for rehabilitation of disabled dependents

The Section 80 DD discount is available to any resident or HUF and is available at:

A. The Cost of treatment (including nursing), training, and rehabilitation of disabled dependent relatives

B. Payment or deposit in the certain scheme for maintenance of disabled dependent relatives.

i. Where disability is 40% or more but less than 80% - a fixed discount of Rs. 75,000.

ii. Where there is a severe disability (disability 60% or more) - A fixed discount of Rs. 1,25,000.

You may also, like- Automated Income Tax Revised Form 16 Part A&B which can prepare at a time of 50 Employees Form 16 Part A&B for the F.Y.2020-21(Who are not able to download Form 16 Part A from the Income Tax TRACES PORTAL, Thy can use this Excel utility)

A certificate of incompetence is required from the designated medical authority to claim this waiver. 201 F-1. From the financial year - the discount limit of Rs. 50,000 has been increased to Rs. 755,000 and Rs. 1,00,000 to Rs. 1,25,000.

Section 80DDB - Medical Expenses

Discount for medical expenses for self or dependent relative

A. For persons under 60 years of age and for HUFs

Discounts of up to Rs 40,000 are available for residential persons or HUFs. It is readily available

B. Who's age above 60 years as senior citizens and super senior citizens

The person or HUF taxpayer on whose behalf such national expenditure is incurred on behalf of the senior citizen can claim a rebate of up to Rs one lakh.

C. For compensation claims

Any reimbursement of medical expenses by an insurer or employer will be deducted from the amount of the exemption that the taxpayer can claim under this section.

Section 80U - Discount for Persons with Physical Disabilities Exemption of Rs.5,000/- In case of severe disability, one can claim a rebate of Rs 1,25,000. Section 80 TTB - Interest Income Reduction in Interest on Deposits of Senior Citizens A new section 80TTB has been seated in Budget 2018 to allow discounts on the interest income from deposits by senior citizens. The limit of this discount is Rs. 50,000. The exemption will no longer be allowed under Section 80TTA.

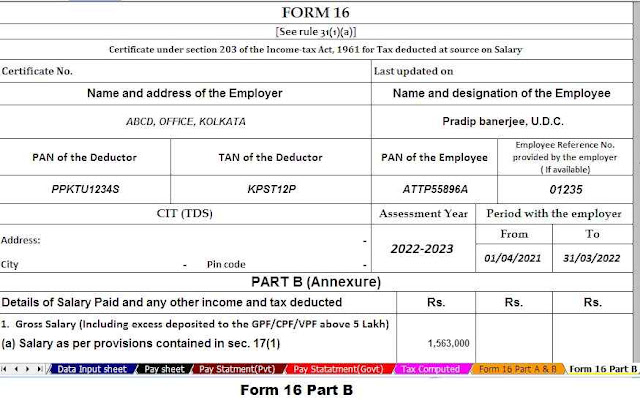

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22