In today's fast-paced world, tax planning is a crucial aspect of financial management. As a responsible

taxpayer, you're always on the lookout for ways to minimize your tax liability while complying with

the law. The introduction of the new tax regime in recent years has brought about significant changes in how taxpayers approach their tax planning strategies. Therefore, One of the key components of this new

regime is the Standard Deduction of Rs. 50,000/-. In this article, we will delve into how choosing the

Standard Deduction can provide substantial benefits to taxpayers.

Understanding the Standard Deduction

What is the Standard Deduction?

In other words, The Standard Deduction is a fixed amount subtracted from your taxable income, reducing the total income subject to taxation. However, In the context of the new tax regime, it offers taxpayers an alternative to the conventional system of claiming deductions under various sections of the Income Tax Act.

How Does it Work?

When you opt for the new tax regime, you forego most deductions and exemptions, simplifying the tax calculation process. However, the government still provides a Standard Deduction of Rs. 50,000/- to all taxpayers, In addition, irrespective of their income sources.

After that, the Benefits of Choosing Standard Deduction

1. Simplified Tax Planning

After that, With the Standard Deduction, tax planning becomes more straightforward. Similarly, You don't need to keep track of multiple deductions and exemptions, making it an attractive option for those seeking simplicity in their financial affairs.

2. Universality

However, The Standard Deduction of Rs. 50,000/- is available to all taxpayers, ensuring that everyone can benefit from this provision. Whether you are a salaried individual, a business owner, or a freelancer, you can claim this deduction.

3. Reducing Taxable Income

Therefore, By choosing the Standard Deduction, you reduce your taxable income by Rs. 50,000/-. This can lead to substantial tax savings, especially for individuals in lower tax brackets.

Who Can Opt for the Standard Deduction?

Above all, The Standard Deduction of Rs. 50,000/- is available to individual taxpayers, In addition, Hindu Undivided Families (HUFs), and senior citizens. It is important to note that the option to select the Standard Deduction is available in the new tax regime introduced in the financial year 2020-21. Taxpayers can choose between the old and new tax regimes based on their financial situation and preferences.

Making the Right Choice

Consider Your Deductions

Before making a decision, it's essential to consider your existing deductions. In addition, If you have substantial deductions under various sections of the Income Tax Act, sticking to the old regime may be more advantageous. However, if you find that the Standard Deduction of Rs. 50,000/- is sufficient to cover your deductions, the new regime could be a simpler and more tax-efficient option.

Consult a Tax Professional

Above all, Taxation can be complex, and the best choice depends on your unique financial circumstances. It's always a good idea to consult with a tax professional who can provide personalized advice tailored to your needs.

Conclusion

In conclusion, the Standard Deduction of Rs. 50,000/- can be a valuable tool in your tax planning arsenal, especially if you are inclined towards the new tax regime. By choosing this deduction, you not only simplify your tax affairs but also enjoy the benefit of reduced taxable income. However, the decision to opt for the Standard Deduction should be made after careful consideration of your specific financial situation and the deductions you currently claim.

FAQs

1. Is the Standard Deduction available to all taxpayers?

- Yes, the Standard Deduction of Rs. 50,000/- is available to individual taxpayers, Hindu Undivided Families (HUFs), and senior citizens in the new tax regime.

2. Can I switch between the old and new tax regimes every year?

- Yes, taxpayers have the flexibility to choose between the old and new tax regimes each year, depending on their financial circumstances.

3. How do I claim the Standard Deduction when filing my taxes?

- When filing your taxes under the new tax regime, you can simply deduct Rs. 50,000/- from your total taxable income.

4. Are there any other deductions available in the new tax regime?

- The new tax regime offers limited deductions and exemptions compared to the old regime. Taxpayers should carefully evaluate which regime suits their needs better.

5. Can I claim the Standard Deduction if I have business income?

- Yes, the Standard Deduction is available to all types of taxpayers, including those with business income, provided they are filing under the new tax regime.

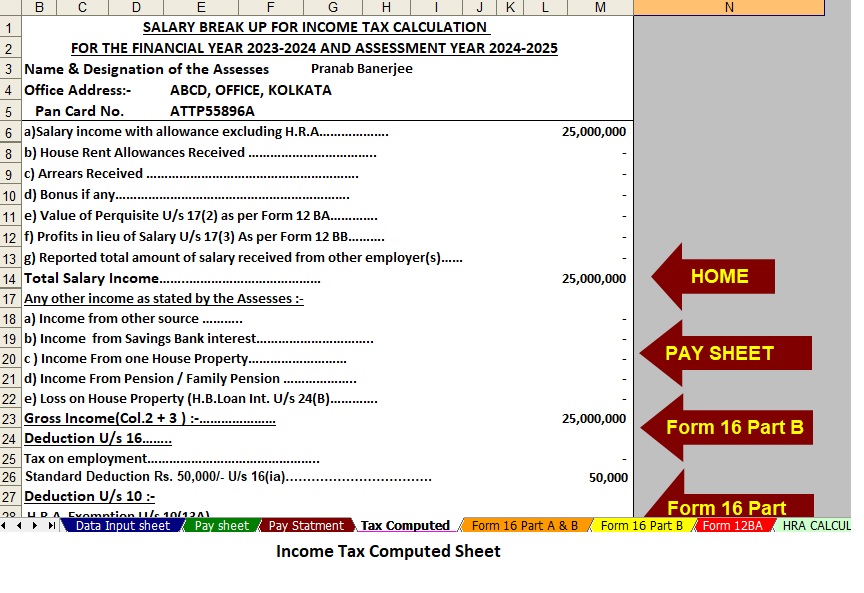

Download Automated Income Tax Preparation Excel-Based Software All in One for the Non-Government (Private) Employees for the F.Y.2023-24 and A.Y.2024-25

Features of this Excel Utility

- The Tax Calculation will be as per the Budget 2023 with New and Old Tax Regime U/s 115 BAC

- This Excel Utility has its own Salary Structure as per the Non-Government (Private) Employees' Salary Structure

- This Excel Utility can prepare automatically your Income tax Computed Sheet Just fill in the Data

- This Excel Utility can Calculate your House Rent Exemption U/s 10(13A)

- For instance, This Excel Utility have a separate Salary Sheet

- For instance, This Excel Utility automatically your Arrears Relief Calculation U/s 89(1) with Form 10E

- This Excel Utility can prepare at a time your Form 16 Part B automatically

- This Excel Utility can prepare at a time Form 16 Part A and B