Joint

Home Loan: Everyone in the world dreams of having their own house. To

make it happen people often plan to take a home loan. But there are many

types of loans one can apply in different banks and financial

institutions. In home loans, joint home loans are much popular than the

other. What makes them so attractive is their ability to distribute the

debt among all the applicants and the maximum sanction limit associated

with this. Apart from this deduction under income tax act for the loan

repayments and interest on loan payments will be available for all the

members of the loan.

[

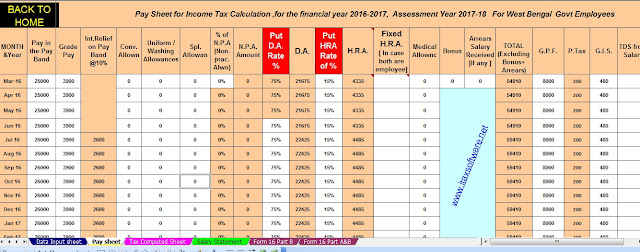

This Excel Based Software can prepare at a time Individual Tax Compute

Sheet + Individual Salary Sheet + Individual Salary Structure as per

W.B.Govt Salary Pattern + Automatic Calculation H.R.A. Exemption

Calculation U/s 10(13A) + Automated Form 16 Part A&B and Form 16

Part B for F.Y. 2016-17]

1. Joint Home Loan:

A joint Home loan is a loan sanctioned to more than one person jointly.

2. Co-borrower:

Among

all the applicants one is called as co-borrower to another. Since they

are taking the loans jointly the burden of repayment will be shared

among themselves. A joint home loan can be taken by up to 6 members.

Generally, people used to take the loan along with their siblings,

spouse or parents etc., Banks allow the joint loans to the siblings if

they are the co – owners of the property.

3. Eligibility for Joint Home Loan:

· Minimum two persons should be there

· There

is no compulsion that the co-borrower should be a co-owner of the house

but it is recommendatory to have co-owner as co-borrower to avoid the

chances of not getting the loans at the very first attempt.

· A married couple always has a chance of getting the joint loans without any problems from the side of the lender.

· Lending

institution asks for the KYC details and proof of identity and proof of

address along with the proof of co-ownership where ever necessary.

4. Tax Benefits on Joint Home Loan:

Section 80C of

the income tax act 1961 allows an assessee to avail the benefit of

deduction towards the repayment of principal amount. And one can avail

the deduction towards interest on loan paid under section 24 of the act.

In

the case of the joint home loan, all the co-borrowers of the loan can

avail the deduction towards the repayment of principal amount along with

interest on the loan. This tax benefits will be proportionate to their

share in the home loan.

Currently,

Rs 1,50,000 can be availed as a maximum tax benefit for repayment of

principal u/s 80C and Rs 2,00,000 can be availed for interest payment.

To

avail this tax benefits the co-borrowers should be the co-owners of the

property. Otherwise, it is not possible to avail the deductions.

5. Repayment of Joint Home Loan:

The

liability of the co-borrowers is joint as well as several. In the case

of any disputes or divorce between the husband and wife, the other who

is ready to enjoy the benefits of the loan will be liable to pay off the

entire loan. So it is better to have an agreement stating the share of

each co-borrower.

6. Planning:

Since

all the co-owners are allowed to have the tax benefit it is advisable

to split their share of the loan accordingly so that person having

maximum tax slab will be allocated majority amount of the loan which

makes it possible to avail optimum tax benefit.