Tips for saving income tax in F.Y 2021-22. This article discusses some tax-saving tips. These tips may help to that every taxpayer must explore to save some income tax.

All of us want to save as much money as possible if it is legally correct. When it comes to saving money for taxpayers, how to save income tax is one of the most sought-after sentences.

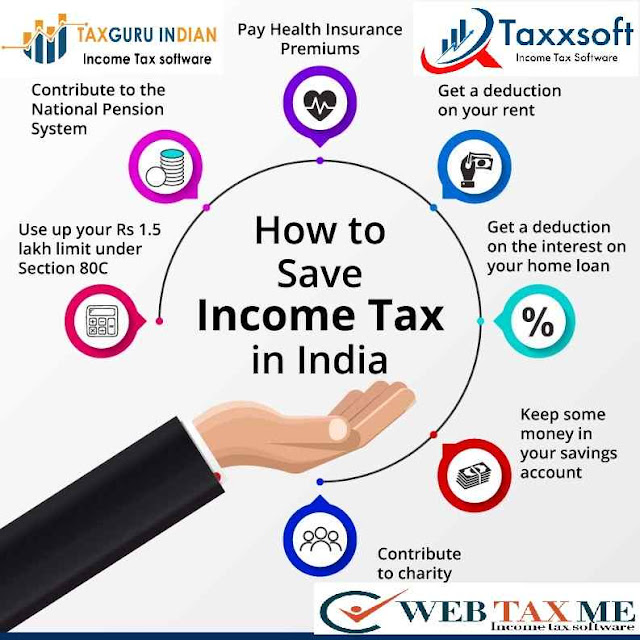

We should all pay our income tax at all times to build the country and strengthen the economy. However, wise, planned, and strategic investments can help us save some money to pave the way for a financially secure future. To save income tax, every taxpayer must look at some of the top options as follows: -

You may also, like- Automatic Prepare at a time 100 Employees Form 16 Part B for the F.Y.2020-21 asper the new and old tax regime U/s 115BAC

Take maximum advantage of 80C: If you plan to save income tax, you must avail of maximum benefits under 80C (Rs 1.5 lakh per year till now).

Anyone can choose the savings certificate of their choice for free, such as people who do not want to take financial risk can fix 5-year tax saver FD, life insurance policy, or other investment products.

Those who are not ashamed to take risks can invest in mutual funds in the ELSS category. There is no difference between the performance of ELSS and a general mutual fund except that the funds in the ELSS category have a lock-in period of 3 years.

Never avoid 80 CCD: To save Rs 15,000 by investing in NPS (National Pension System) Scheme or APY (Atal Pension Scheme), one should also consider using the maximum limit under 80 CCD (Rs 50,000 so far).

There is a myth that NPS gives very low returns compared to other available products, which is absolutely wrong. You can compare the effectiveness of all the funds under this section and choose the fund of your choice. 50% of your funds are invested in these market-linked products and 50% in government bonds. This ratio is changed by the fund manager every year and you have a 100% share of your funds in the funds market until retirement.

Since the appraisal has already saved ১৫ 15,000 in taxes, what you are earning is actually earning, 35,000, so if you save under this category, your actual income is much higher. However, products under 80CCD are the only pension funds, so there are some restrictions on the withdrawal of funds, you must consider it before investing.

You may also, like- Automatic Prepare at a time 100 Employees Form 16 Part A&B for the F.Y.2020-21 as per the new and old tax regime U/s 115BAC

Triple Benefit of Home Loan: Owning a home offers triple benefits of long-term home rent savings, property appreciation, and tax benefits. If you have rented property, your rental expenses are going to increase every year, where your EMI is almost fixed (if interest rates do not change). 1.5 lakh under. Under ‘Housing for All’, the government is offering tax exemption of up to Rs 3.5 lakh (Rs 2 lakh under Section 24), which cannot be avoided.

In addition, you can purchase a residential property and save tax under multiple categories as per the following schedule: -

Section 24 (b) The maximum tax benefit as interest on a home loan is Rs. 2,00,000.

.

The stamp duty value of Rs.150,000 home interest property for 80 EEA should be up to Rs.45. This must be done between April 1, 2021, and March 31, 2021

80C -Rs 1,50,000 -Home and Principal- Property should not be sold within 5 years of possession.

So if you claim all taxes on all the above elements, you can claim maximum income tax exemption. 5 lakh rupees

In addition, let's take a look at A summary of other income tax protection options: -

You may also, like- Automatic Prepare at a time 50 Employees Form 16 Part B for the F.Y.2020-21 asper the new and old tax regime U/s 115BAC

Coming to musical instruments below Section 80C

1. In Life Insurance Premium Mutual Funds (ELSS category only), PPF, FD (5 years, only tax saver), Post Office Deposits, National Reserve Scheme

2. Payment of tuition fee (maximum 2 children)

3. The Main payment of housing loan

80 CCD investment in National Pension System (NPS), Atal Pension Scheme (APY).

The 80D premium paid for medical insurance for self, wife, and children.

Pay for medical insurance for premium parents.

80E Education Loan Interest paid for self, spouse, or children. Interest is paid for 8 years only.

80EE interest for first-time homeowners. The home value should be <= 50Lac and the value of an should be <= 35 lakh.

80G grants from various governments, approved charities, social and government agencies. (50% amount can be claimed for any company)

80 GG house rent has been paid, where the person is not getting HRA and does not own any property.