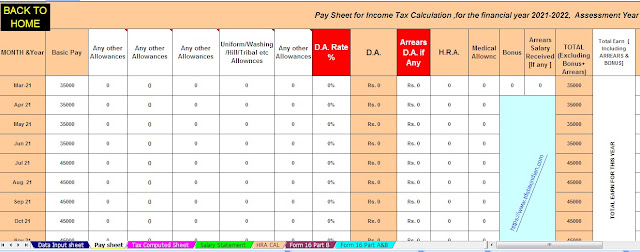

Download Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E. There are 2

components to a home loan repayment such as principal repayment and interest repayment. Since there

are 2 different components to debt repayment, the tax benefits of a home loan are regulated by different

sections of the Income Tax Act and are claimed as tax deductions under different sections when filing

an income tax return.

Home loan tax benefits

Approved for paragraph cuts

Section 24 Rs 2,00,000 interest payable

Section 80C Rs.1,50,000 principal payment

Section 80EEA Rs.1,50,000 pays interest

Section 80EE Rs.50,000 interest payment

The following are the benefits of a home loan which can be claimed as a deduction: -

These categories under which tax benefit can be claimed on home loans are explained below: -

Section 80C: Tax Benefit on Home Loan (Original Amount)

The amount paid by an individual / HUF as repayment of the principal amount of the home loan is approved as tax deduction under Section 80C of the Income Tax Act. The maximum tax deduction allowed under section 80C is money. 150,000

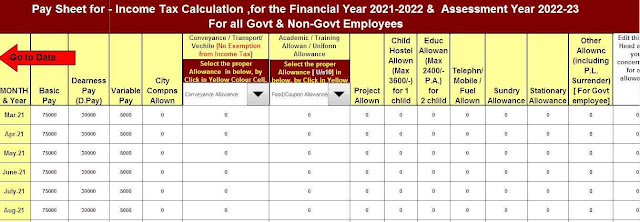

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Non-Govt(Private) Employees for the F.Y.2021-22

This tax deduction is the total deduction allowed under section 80C and includes money invested in PPF accounts, tax-saving fixed deposits, equity-oriented mutual funds, national savings certificates, senior citizen savings schemes, etc.

This tax deduction under section 80C is available on a paid basis regardless of the year for which the payment has been made.

Furthermore, if you are planning to purchase a property under construction because it is priced lower than the completed property, you are also requested to note here that GST is also levied on the property under construction.

Homes cannot be sold within 5 years

Section 80C (5) also states that if the assignee transfers the home property on which he has claimed tax deduction under section 80C before the end of the financial year where he got possession, then no deduction on home loan under section 80C. And tax benefits will not be allowed.

In the case of previous years, the total amount of tax deduction already claimed will be treated as the assessee's income for the year in which the property was sold and will be liable to pay tax on the assessed income.

Tax Benefit on Home Loan (Amount of Interest)

Section 24(B): Income tax benefit on interest on the loan for purchase/construction of the real estate

Pursuant to Section 24, income from the home property will be deducted by the amount of interest paid on the loan taken for the purpose of purchase/construction/repair/renewal/reconstruction of the property.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Govt and Non-Govt(Private)Employees for the F.Y.2021-22

The maximum tax deduction allowed under section 24 of a self-acquired property is Rs. 2 lakh (increased from Rs 1.5 lakh to Rs 2 lakh in the 2014 budget).

If the property for which the home loan has been taken is not self-acquired, no maximum limit has been set in this case and the taxpayer can avail full tax deduction under section 24.

PLEASE NOTE: If a property is not self-occupied by the owner due to his job, business or occupation in another place, then he has to live in another place that is not his, then the amount of tax deducted under section 24 will be Rs. Only 2 lakh rupees.

In addition, if the acquisition/construction of the property is not completed within 5 years from the end of the financial year in which the loan was taken, the interest benefit, in this case, will be reduced from Rs 2 lakh to Rs 30,000. (The limit has been increased from 3 years to 5 years from FY 2016-17).

Budget 2021 update

In the case of self-acquired property, the interest paid is deducted from the rent paid to reach income from the house property. In some cases, the interest paid may be higher than the rent earned, resulting in a loss of home property. This loss is allowed to set off with income from any other head

The Finance Act 2021, promulgated on February 1, 2017, places a limit on the maximum amount of losses that can be deducted from other major sources of income under the main house property. From the financial year 2017-18,

Pre-construction interest income tax treatment

In many cases, the payment for the purchase of property is made before the construction work is completed. Some home buyers buy property on credit before construction is completed and start giving EMIs to banks.