There is no denying the need for adequate health insurance in your insurance portfolio. If you feel you can’t afford health insurance premium, just imagine how you will afford the treatment cost, if you were to get hospitalized. Even the government wants you to purchase health insurance. Though it won’t pay the premium on your behalf, but the government certainly does its bit to ease the burden on your pocket through tax incentives.

Let’s look at tax incentives for expenses on health insurance and certain specific medical expenses.

Section 80D (Health Insurance Premium Payment)

You can claim deduction up to Rs.25,000 per financial year for health insurance premium payment. The premium shall be for self, spouse, and dependent children. If either you or spouse is a senior citizen (60 years and above), the limit goes up to Rs 30,000.

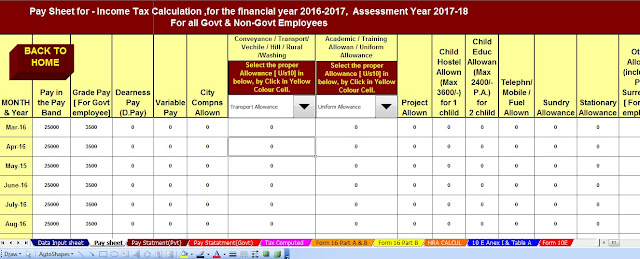

Download All in One Income Tax Preparation Excel Based Software for Central Govt Employees for F.Y.2016-17 [ This Excel Utility can prepare at a time your Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure + Automatic H.R.A. Exemption Calculation + Automated Form 16 Part A&B and Form 16 Part B for F.Y.2016-17]

a) Preventive health check-up

You get tax benefit on preventive health check-up. Within the aforesaid limit of Rs 25,000 (or Rs 30,000 as the case may be) under Section 80D, you can also claim expenses incurred towards preventive health check-up till Rs 5,000 per financial year.

Note: Health Insurance premium paid for siblings is not eligible for tax deduction.

b) Health insurance policy for parents

Health insurance premium paid for parents is also eligible for deduction up to Rs 25,000 per financial year. If either of your parents is a senior citizen, the limit goes up to Rs Rs 30, 000 per year. This limit also subsumes Rs 5,000 that can be incurred towards your parents’ health checkup.

c) No tax benefit on cash payment

Health insurance premium shall be made through banking channel (cheque, demand draft, credit and debit cards, net banking etc). The tax benefit is not available for cash payments. However, payment for preventive health checkup can be made in cash.

d) Health insurance for very senior citizens

For very senior citizens (80 years and above) who are uninsured, you can claim deduction up to Rs 30,000 per financial year towards medical treatment. This is not just for own expenses.

If your father is a very senior citizen (and uninsured) and mother is a senior citizen, you can claim deduction up to Rs 30,000 towards your medical treatment for parents, health insurance and check-up of both parents.

Section 80DDB (Treatment of Specified Illnesses)

You can avail deduction up to Rs 40,000 (Rs 60,000 for senior citizens and Rs 80,000 for very senior citizens) for medical expenses incurred for specified ailments such as cancer, chronic renal failure, Parkinson disease etc. A complete list of such ailments is provided in Rule 11DD.

You need to attach a certificate from the specialist doctor while filing income tax returns.

You can claim for self, spouse, parents, children and siblings.

Section 80DD (Treatment of a dependent with disability)

You can claim deduction up to Rs 75,000 for expenditure towards medical treatment, nursing, training rehabilitation and maintenance of a dependent with disability (Rs 1.25 lakh for severe disability). Dependent can be spouse, parents, children and siblings.

You need to submit a supporting medical certificate.

Section 80U (Person with disability)

A person with a disability can claim the deduction of Rs 75,000 under Section 80U. In a case of severe disability, the limit goes up to Rs 1.25 lakh. There is no relation to treatment costs.

Medical Allowance under Section 17

The amount paid (with your salary) by your employer towards expenses for medical treatment of your family (self, spouse, children, dependent parents, and siblings) is exempt from income tax to up to Rs 15,000 per financial year.