Income tax exemption is available for F.Y.2021-22. The relief is given to the

taxpayers by the government are reduced through which they can legally save

their taxes through various platforms such as investing their money.

Which are all the exemptions that can help us save our taxes?

1. Deduction U/s 80C

Exemption from the 80 C is one of the most popular and easy ways out of all other discounts. The Maximum Limit is Rs. 1,50,000/-

L.I.C. Insurance Premium,

Consolidated capital

• Term deposit such as fixed deposit, recurring deposit, post office term deposit (minimum 5 years lock-in period)

Bonds issued by NAB NABARD

Recognized Provident Fund

Equity-Linked Savings Scheme (ELSS)

National Pension Scheme (NPS)

National Savings Certificate (NSC)

Up to 2 tuition fees are paid in schools, colleges, universities etc. located in India

Senior Citizens Savings Scheme

You may also, like- Automated Income Tax Software in Excel for the West Bengal State Employees for the F.Y. 2021-22 [ This Excel Utility can prepare at a time your Tax Computed sheet as per new and old tax regime U/ 115 BAC + Individual Salary Structure as per the W.B.Govt Employees Salary Pattern after ROPA 2019 + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]

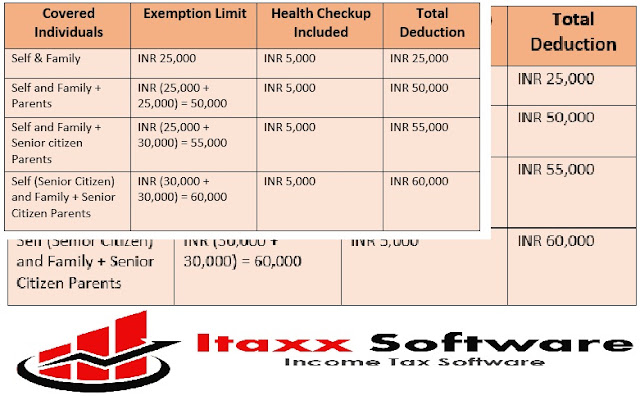

2. 80D

The medical Insurance can claim Rs. 25,000/- for below 60 years of age and

Rs.30,000/- can claim for the Senior Citizen above 60 years of age

.

Pension plan.The limit is Rs. 1,50,000 / - including (80C, 80CCC, 80CCD (1)).

1. Section 80CCD (1) - Contributed to National Pension Scheme (NPS) account

10% of salary (in case of an employee) and 20% of total income (in case of a

self-employed person)

2. Section 80CCD (1B) - 50,000 / - for money deposited in NPS account (above

and above the limit of Rs.1,50,000 / -) Additional deduction of the contribution

made by the employee is allowed (in case of salaried persons and self-

employment)

3. Section 80CCD (2) - Additional deduction on the contribution up to 10% of the

employer's salary (basic salary + allowance).

You may also, like- Automated Income Tax Software in Excel for the Assam State Employees for theF.Y. 2021-22 [ This Excel Utility can prepare at a time your Tax Computed sheet as per new and old tax regime U/ 115 BAC + Individual Salary Structure as per the Assam State Govt Employees Salary Pattern after ROPA 2019 + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]

4. Discount between 80GG

This discount is available if a personal appraiser does not receive a home rent

allowance. It is available in the following amounts for the cost of rent paid for his

own residence-

• 5000 / - p.m.

• Minus 10% of total aggregate income has been paid as rent

25% of total gross income

Fo gets these benefits must submit a declaration on Form 10BA.

5. Discount between 80DDB

This discount is available for the resident person / HUF at the cost of treatment of

a patient suffering from a disease referred to in Rule 11DD-

. 40,000 / - or less, whichever is less (under 60 years of age)

.1 Rs.1,00,000 / - or less, whichever is less (60 years and above)

6. 80 E-

This discount is available for interest on loans taken by an individual from a

financial institution or an approved charity for higher education for himself, his

wife or children.

It is available for a maximum of 8 years starting from the year where interest starts to be paid.

You may also, like- Automated Income Tax Software in Excel for the Bihar State Employees for the F.Y. 2021-22 [ This Excel Utility can prepare at a time your Tax Computed sheet as per new and old tax regime U/ 115 BAC + Individual Salary Structure as per the Bihar State Govt Employees Salary Pattern after ROPA 2019 + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]

7. A discount of 80EE the Maximum limit is Rs.50,000/-. The conditions for getting this discount are-

1. Loan has been sanctioned between 01.04.2016 to 31.03.2017

2. The amount of loan approved for acquisition is not more than Rs. 35 lakhs

3. The value of residential house property is not more than Rs 50 lakh

Assessors do not own any residential home property on the date of grant.

11. Discount of 80EEA

8. Exemption from Savings Bank or Post Office U/s 80TTA Maximum Rs. 10,000/- as a Savings Bank/Post office Interest

9. Discounts within 80TTB

Discount up to Rs. 50,000 / - on interest income earned by senior citizens from deposits in banks, post offices or co-operative banks. Also, this discount is available for interest earned on term deposits.

You may also, like- Automated Income Tax Software in Excel for the Andhra Pradesh State Employees for the F.Y. 2021-22 [ This Excel Utility can prepare at a time your Tax Computed sheet as per new and old tax regime U/ 115 BAC + Individual Salary Structure as per the Andhra Pradesh State Govt Employees Salary Pattern after ROPA 2019 + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]

10. 80U-

This discount is available for residents with disabilities. Cutting is allowed until-

. 75,000 / - if disability is 40% - 80%

Severe Rs.1, 25,000 / - if severe disability i.e. 80% or more

11. Standard Deduction - Standard Deduction of Rs. 50,000 / -

12. House Rent Allowance- Section 10 (13A) provides at least one of the following exemptions-

I actually got that allowance

10 More than 10% of salary is rented

Sala Salary 50% (in Metro City) / 40% Salary (Non-Metro City)

Rs. 100 / - per PM for child education up to 2 children per child

Rs. 300 / - PM Hostel expenses up to 2 children per child

Discount Travel Discount - Travel expenses in India can be claimed as actual travel discounts on travel expenses paid by the employer on himself or his family.

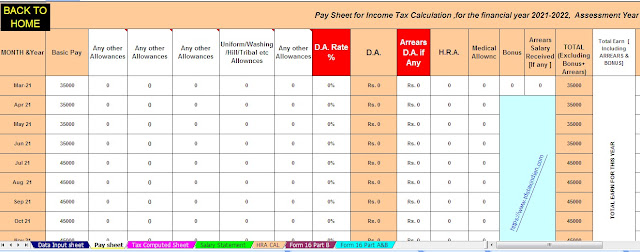

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet As per new and old tax regime U/s 115 BAC

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount into the in-words without any Excel Formula