Allowance - 'Salary' for calculating income. An allowance is a fixed amount of money that an

the employer pays an employee to cover certain expenses, personal or in the performance of his or her

duties.

These allowances are generally taxable and are included in the total salary unless a specific discount is given in the case of any such allowance. Specific exemptions have been granted for allowances under the following categories:

(i) H.R.A.- Section 10 (13A)- House Rent Allowances

(ii) Scheduled Special Allowance - Section 10 (14)

The above allowances will be waived in full or up to a certain limit and the balance, if any, will be taxable and thus included in the total salary.

You may also, like- Automated Income TaxPreparation Excel Based Software All in One for the Non-Govt(Private) Employees for the F.Y.2021-22 as per Budget 2021 [This Excel Utility can prepare at a time your Income Tax Computed Sheet as per new and old tax regime U/s 115 BAC + Individual Salary Structure as per all Non-Govt Employees Salary Pattern + Automated Income Tax Form 12 BA + Automated H.R.A. Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B]

The full entertainment allowance received by an employee is first included in the total salary and then under section 16 (ii) only a government employee is exempted from the total salary due to such entertainment allowance which has already been included.

Some allowance treatments are as follows:

1. H.R.A.-U/s 10 (13A) and [Rule 2A]

Amount of discount: The following three limits:

Kolkata / Mumbai /

(i) Allowance actually received Allowance actually received

(ii) More than 10% of the rent has been paid

(iii) 50% of salary 40% of salary

Note:

Exemption for HRA is based on the following:

(1) Salary

(2) Accommodation

(3) Rent has been paid

(4) Received HRA.

As long as there is no change in any of the above factors can be counted together for that period. Whenever any of the above changes, it should be calculated separately until the next change.

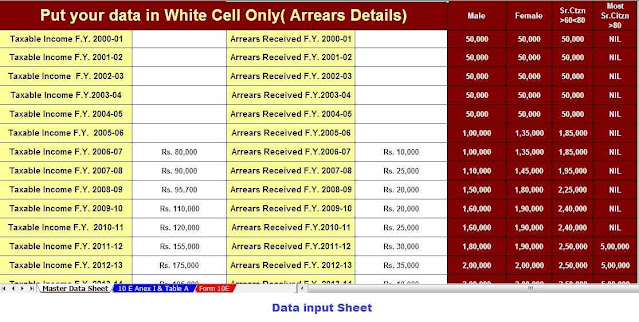

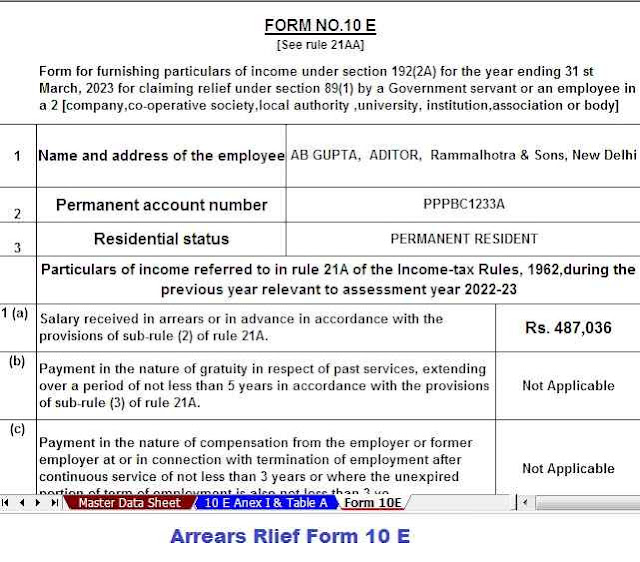

You may also, like- Automated Income Tax Salary Arrears Received Calculator U/s 89(1) with Form 10 E for the F.Y.2021-22

2. Prescribed special allowance which is exempt from a certain amount - Section 10 (14)

(i) Special allowance for discharge of government duties:

These allowances are not of a favorable nature in the sense of section 17 (2) and are specifically allowed to cover expenses in full, necessarily and exclusively in the case of official duties or for-profit employment. These allowances will be discounted to the extent that they are actually spent for that purpose. [Section 10 (14) (i)].

These allowances are:

Whatever allowance may be given in any name to encourage academic, research and training practice in educational and research institutions;

An allowance, whatever the name may be is used to cover the cost of purchasing or maintaining uniforms for office wear or for profit.

The above allowances will be discounted to the following minimum amount:

1. Received actual allowance.

2. Actual money has been spent for office or job responsibilities.

These allowances can be of two types:

1. The amount of allowance received or the prescribed limit, whichever is less is limited.

A. Children's education allowance:

The actual amount received per child or discount up to 100 p.m. Up to a maximum of 2 children per child, whichever is less.

The actual amount received per child or discount up to 300 p.m. Up to two children per child, whichever is less.

Note:

(1) An appraiser claiming a waiver in respect of the allowance referred to under section (h) above shall not be entitled to a waiver in the case of allowance in the volatile area mentioned under section (e) above.

(2) It may be noted that the allowances mentioned in paragraph 4.13b above are exempted from the amount or limit of the amount received, whichever is less. In this case, there is no relevance to the actual expenditure. For example, if an employee gets Rs 2,000 as a transport allowance for travel between accommodation and duty and actually spends Rs 1,200. For this purpose, in this case, the discount would be 1,600 pm even though the money actually spent was 1200 pm

(3). Recreation allowance treatment

This cut is only allowed for one government employee. Private employees will not be eligible for any discount due to the entertainment allowance received by them.

In the case of entertainment allowance, the wife is not entitled to any discount but she is entitled to deduction under section 16 (ii) from the total salary. Therefore, the full entertainment allowance received by any employee is added to the calculation of the total salary. The Government servant is entitled to a deduction from the total salary under section 16 (ii) within the following 3 limits due to such entertainment allowance.

1. Actual entertainment allowance received in the previous year.

2. 20% of his salary excluding any allowance, benefits or other accessories.

3. 5,000 rupees.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22