Section 87A Rebate Limit Increased to Rs. 5000, Changes in Section 87A by Finance bill 2016, The Finance Budget 2016, Section 87A Rebate Limit Raised to Rs. 5000. Rebate under Sec 87A: With the objective of providing relief to resident individuals in the lower income slab i.e. total income not exceeding Rs. 5,00,000, section 87A is proposed to be amended so as to increase the maximum amount of rebate available from existing limit of Rs.2,000 to Rs.5,000. Earlier this limit is only available for Rs 2000 now this limit is increased by Rs 3000 and now the Total limit for Section 87A for AY 2017-18 is Rs 5000. Check more details regarding “Section 87A Rebate Limit Increased to Rs. 5000 – Budget 2016” from below…..

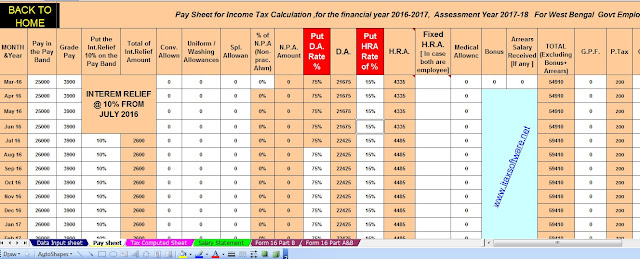

Click here to Download the Automated All in One Income Tax Preparation Excel Based Software for West Bengal Govt employees for F.Y.2016-17& A.Y.2017-18.[ This Excel Utility can prepare at a time Tax Compute Sheet + Individual Salary Structure with new amended Interim Relief @ 10% + Automated H.R.A. Calculation + Automatic Form 16 Part A&B and Form 16 Part B with the all amended by the Finance Budget 2016 ]

Section 87A Rebate Limit Increased to Rs. 5000

The existing provisions of section 87A of Income-tax Act, provide for a rebate of an amount equal to hundred per cent of such income-tax or an amount of two thousand rupees, whichever is less, from the amount of income-tax to an individual resident in India whose total income does not exceed five hundred thousand rupees.

With the objective to provide relief to resident individuals in the lower income slab, it is proposed to amend section 87A so as to increase the maximum amount of rebate available under this provision from existing Rs.2,000 to Rs.5,000.

This amendment will take effect from 1st April 2017 and will accordingly apply in relation to the assessment year 2017-18 and subsequent assessment years.