There are huge changes in income tax rules applicable for FY 2016-17 due to budget 2016-17 changes. In this post, We have covered all the changes in short.

INCOME TAX RULES APPLICABLE FOR FY 2016-17 AY 2017-18:

· No change in income tax slab for FY 2016-17. Basic exemption limit is same Rs.2,50,000 for non-senior citizen and Rs.3,00,000 for senior citizen & Rs. 5,00,000/- for most Sr.citizen.

· Increased Exemption U/s 87A Rs.5,000/- from Rs. 2,000/-

· Additional Rs.50,000 income tax deduction for interest on housing loan is available for the first-time buyer of house U/s 80EE. The loan should not be more Rs.35 lakhs and cost of the house should not be more than Rs.50 Lakhs.

· Section 80GG deduction is increased from Rs. 24,000 to Rs.60,000.

· Any payment received from sukanya samriddhi scheme is exempt.

· For deduction under section 80DDB, the limit is increased from Rs. 60,000 to Rs.80,000.

· Deduction limit for Section 80D is increased by Rs.10,000 for nonsenior citizen and senior citizen. For General below 60 Years citizen, the limit is Rs. 25,000 and for a senior citizen, the limit is Rs. 30,000.

· Deduction limit for section 80DD has been increased from Rs. 50,000 to Rs.75,000. For severe disability, the limit is increased from Rs. 1 Lakhs to Rs.1.25 Lakhs

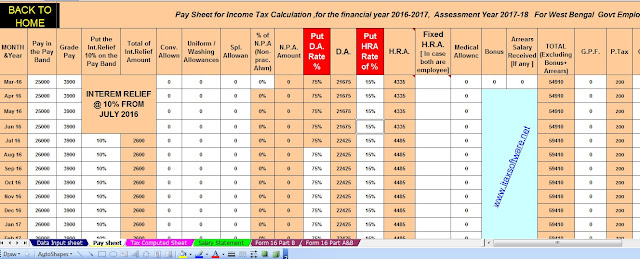

Download Automated 100 employees Master of Form 16 Part A and B for F.Y.2016-17 [ This Excel utility can prepare at a time 100 employees Form 16 Part A and B for Financial Year 2016-17 & Ass Yr 2017-18 with all changes by the Finance Bill 2016]

·

· For contribution to NPS ( National Pension Scheme) under section 80CCD(1), the limit is increased from Rs. 1.5 Lakhs.

· Additional deduction up to Rs. 50,000 is allowed for contribution above Rs. 1.5 Lakhs in the national pension scheme. U/s 80CCD(1B)

· Transport allowance exemption limit has been increased from Rs. 800 to Rs.1,600 P.M. for General and Rs. 3200/- P.M..for Phy.disable person.