According to the budget proposed on Feb 29th, 2016, one can avail the Income Tax exemption on a home loan. Basically, the first time home buyer can get income tax benefits on housing loan by claiming a number of deductions. The latest Budget Update states that the first time home buyers are going to get an additional exemption of Rs. 50,000/- for interest on home loan under section 80EE.

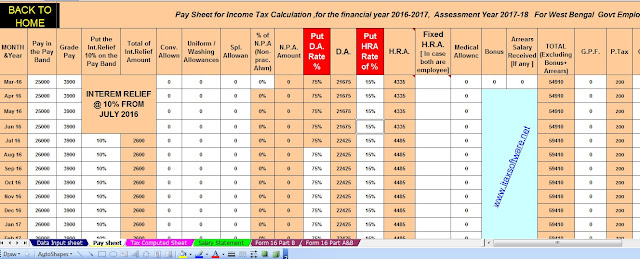

Download Automatic Income Tax Software All in One for West Bengal Govt Employees for Financial Year 2016-17.[ This Excel Utility can prepare at a time your Individual Salary Structure as per W.B Govt Salary Pattern with Interim Relief + Individual Salary Sheet + Individual Tax Compute Sheet + Automatic H.R.A. Exemption Calculation + Automatic Form 16 Part A&B and Form 16 Part B for F.Y.2016-17]

To understand the key tax benefit on a home loan, we are bifurcating the repayment techniques into four major elements- tax benefits on principal repaid, tax benefits on interest paid, deduction on pre-construction interest and section 80EE income tax benefits. The next section will let you know the concept of all in detail.

Tax Benefits on Principal Repaid

Under section 80C of the Income Tax Act, the maximum deduction allowed for the repayment of the principal amount of home loan is Rs. 1.5 lakh. Deduction under section 80C also includes investments done in the PPF Account, Equity Oriented Mutual funds, Tax Saving Fixed Deposits, National Savings Certificate, etc. subject to the maximum of Rs. 1.5 lakhs.

Besides this, there are stamp duty and registration charges that one can claim under the aforementioned section. Though, the claim can only take place in the year in which the payment has been made.

Nevertheless, there’s a condition under which this repayment of the principal amount of housing loan is allowed. The deduction is only possible after the house gets entirely completed and there is a completion certificate for the same. Any under construction structure is not going to be a part of this section.

Service Tax will be charged on any under-construction premise because it would be priced lower than the full-fledged property. Although, no such criteria is there on a fully completed house. So, make your plans accordingly.

The assessee should also note that there won’t be any tax benefit or deduction on home loan under Section 80C if he/she transfers the property before the expiration period of 5 years from the end of the Financial Year in which he obtains the possession.

Tax Benefits on Interest Paid

Under section 24 of the Income Tax Act, one can avail the deduction on Home Loan for payment of Interest tax benefit. The self-occupied property allows the deduction with the maximum limit of Rs. 2 lakh if it takes the completion within 3 years from the end of the Financial Year, otherwise Rs. 30,000.

Another case here is when the house is not self-occupied. In that scenario, there would be no maximum limit as the taxpayer is allowed to deduct tax on the whole interest amount.

Interest amount on a home loan is allowed as the deduction on an accrual basis under section 24. Here, the payment basis differentiates to that from the Section 80C in a way that the claim will be there even if the payment has not been made during the whole year while there’s no such thing in the latter.

Deduction on Pre-construction Interest

One can also get a pre-construction interest claim from the financial year just like availing the deduction for interest that can be claimed when the construction completes at the starting of the same year. In five uniform installments, you can deduct the claim, combining up the whole pre-construction interest. Nevertheless, the amount should not be deducted beyond Rs. 2 Lakh in the case when you use it for your own place.

Section 80EE Income Tax Benefit

As per announcement in last budget session, the limit has raised for the year 2016-17 (Under the section 80EE, there will be a tax benefit to the first time house owners who own the house of Rs. 50 lakh or less, and has acquired the loan amount of less than or equal to Rs. 35 lakh. The maximum limit is Rs. 1.5 lakh that can be claimed under this section. For this, the loan should be sanctioned between April 1, 2016, and March 31, 2017.) This deduction shall be in addition of Rs. 2 Lakhs allowed under section 24(b) of the Income Tax Act, 1961.