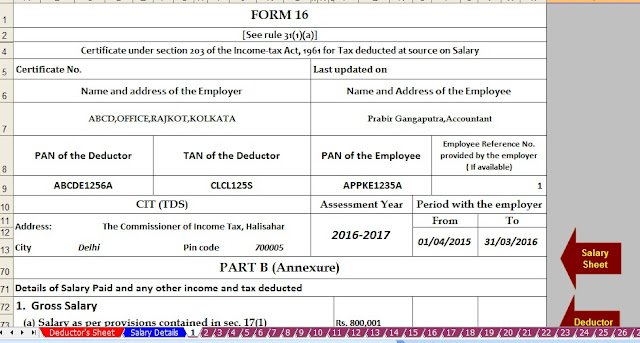

1) Download Govt & Non-Govt Employees All in One TDS on Salary (Both can use) for the Financial Year 2016-17 (Income Tax Computed Sheet + Arrears Relief Calculator U/s 89(1) + Form 10E + House Rent Exemption Calculation U/s 10(13A) + + Automated Form 16 Part A&B and Form 16 Part B)

2) Download Non-Govt Employees All in One TDS on Salary For Financial Year 2016-17 (Income Tax Computed Sheet + Arrears Relief Calculator U/s 89(1) + Form 10E + House Rent Exemption Calculation U/s 10(13A) + Form 12 BA +Automated Form 16 Part A&B and Form 16 Part B)

3) Download Central Govt Employees All in One TDS on Salary for Financial Year 2016-17 ( Income Tax Computed Sheet + Salary Structure + House Rent Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B and Part B)

4) Download All State Employees All in One TDS on Salary for Financial Year 2016-17 ( Income Tax Computed Sheet + Salary Structure + House Rent Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B and Part B)

5) Download West Bengal Govt employees All in One for Financial Year 2016-17 ( Income Tax Computed Sheet + Salary Structure + House Rent Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B and Part B)

The New Finance Budget 2016-17 has already Passed and the Income Tax Slab for the financial year 2016-17 is same up to Rs. 2.5 Lakh is NIL and Section 80 C is also same up to Rs. 1.5 Lakh. More one Section have added in the section 80C AS U/S 80CCD(1B) Which deduction Max Rs. 50 thousand as additional of U/s 80C. And the Tax Rebate U/s 87A have raised up to Rs.5 thousand from the F.Y.2016-17

This Financial Year 2016-17 has continuing and middle in the Financial Year. The 2nd Quarter of 24Q is knocking to submit the Tax amount deposit into the Central Govt through the 24Q or 26Q Tax Challan. So you can prepare your Tax Liability for this financial year 16-17 and deposit the amount of Tax in 2nd Quarter.

If you have one unique Excel Based Software like as All in One TDS on Salary, which can prepare at a time your (Income Tax Computed Sheet + Arrears Relief Calculator U/s 89(1) + Form 10E + House Rent Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B and Part B) for the Central Govt Employees, All State Govt Employees, All Non-Govt Employees and Govt & Non Govt employees in different Excel based Software, so it will be easy to prepare and preserve the all of Calculation in future.

The Salary Structure of Central Govt is differ from another any State Employee's Salary Structure, also the differ the Salary Structure of any Non - Govt Employees Salary and Pay Structure. In this Regard, prepared the Salary Structure for each Concerned Employees in these Excel Utility.