It's time for first working of any works at your office, but the Income Tax Calculation with all exemption like as House Rent Exemption Calculation or Arrears Relief Calculation with Form 10E OR prepare the Form 16, if you can do one by one, there can take much time to prepare and calculation the above all calculation. Also if your Concerned have more than 40 or 100 employees who're the preparation of all of above calculation one by one it will be a hazard and take huge time to prepare the same of all employees calculation.

But If you have one unique Excel Based Software like as All in One TDS on Salary, which can prepare at a time your (Income Tax Computed Sheet + Arrears Relief Calculator U/s 89(1) + Form 10E + House Rent Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B and Part B) for the Govt. & Non-Govt. employees with all amended by the Finance Budget 2017-18. So it will be easy to prepare and preserve the all of the Calculation in future.

You can treat this Excel Utility as an Advance Tax Calculator and guess the all employees Taxable Income with all deductions at a glance.

Download the All in One TDS on Salary for Govt and Non-Govt Employees for the Financial Year 2017-18 & A.Y. 2018-19. [ This Excel Utility Can Prepare at a time Income Tax Computed Sheet + Arrears Relief Calculator U/s 89(1) + Form 10E up to F.Y.2017-18 + House Rent Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B and Part B]

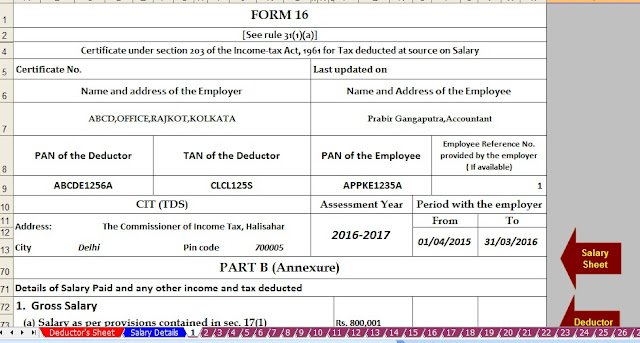

Deductor's Details Sheet

|

Salary Structure for Non-Govt Employees

|

Income Tax Computed Sheet

|

Automated Form 16 Part B

|

Main Sheet for Arrears Relief Calculator up to F.Y.2017-18

|

Arrears Relief Calculation Sheet

|

Arrears Relief Form 10E

|