The Income Tax Act and the Profession Tax Act provides various income tax deductions under Section 80DD, 80DDB and 80U for differently-abled (disabled and handicapped) people.

Most states in India allow a professional tax exemption for any person suffering from a permanent disability.

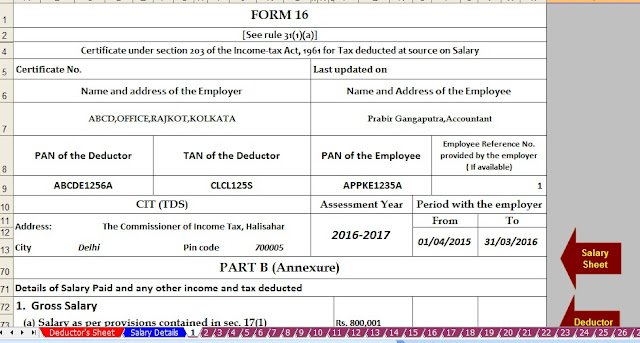

Download All in One Income Tax Preparation Excel Based Software for Govt & Non-Govt Employees for F.Y.2016-17 & A.Y.2017-18. [This Excel Utility can prepare at a time Tax Compute Sheet + Individual Salary Structure + Individual Salary Sheet + Automatic H.R.A.Exemption Calculation + Automated Arrears Relief Calculation with Form 10E + Automated Form 16 Part A&B and Form 16 Part B ]

Section 80U

Under Section 80U a mentally or physically challenged person can claim an income tax deduction of up to Rs 75000 provided he/she suffers from over 40% of the identified disabilities notified as per the Income Tax Act. In the case of severe disability of over 80%, the disabled person can claim an income tax exemption up to Rs.125,000.

Disabilities included under Section 80U include blindness, low vision, leprosy-cured, hearing impairment, mental retardation, mental illness, locomotor disability. Documents related to the expenses don’t have to be produced if you are claiming for self.

However, you are required to submit a medical certificate authenticating the disability of the dependent from a certified medical professional to claim an income tax deduction. This certificate is not required at the time of filing taxes but may have to submit to an assessing officer, if demanded.

Section 80DD

Under Section 80DD the expenses on maintenance/ medical treatment of disabled dependents can be claimed as an income tax deduction. Dependents include spouse, children, parents, brothers and sisters and the income tax deduction is valid only if they have not already claimed a benefit under Section 80U. Income-tax Deduction for expenses for partially disabled dependants (severity 40-80%) is allowed up to Rs.75,000 while it goes up to Rs 1.25 lakh if the dependant is over 80% disabled. The plus side is that even if your actual expenses are lesser than Rs 75000 you can claim a full deduction.

Section 80DDB

Section 80DDB allows an income tax deduction on expenses incurred on medical treatment of various ailments. This included Neurological Diseases where the disability level has been certified to be of 40% and above (including Dementia, Dystonia Musculorum Deformans, Motor Neuron Disease, Ataxia, Chorea, Hemiballismus, Aphasia, Parkinson’s Disease), Malignant Cancers, Full Blown Acquired Immuno-Deficiency Syndrome (AIDS), Chronic Renal failure, Hematological disorders including Hemophilia and Thalassaemia.

Income tax deduction for any of the above diseases ranges between Rs 40000 to Rs 80000 depending on your age and income tax slab.