What is PPF ?

PPF stands for Public Provident Fund which is backed by

Indian Government. PPF is the most common investment for a number of decades.

Its features like guaranteed

return, tax exemption under section 80C as well as tax free interest makes it the most popular investment

among the risk adverse investors. Any person whether employed or self

employed can invest in the scheme.

Another benefit in PPF is that the amount in PPF account cannot be attached under a

court order for

recovery of a loan or liability.

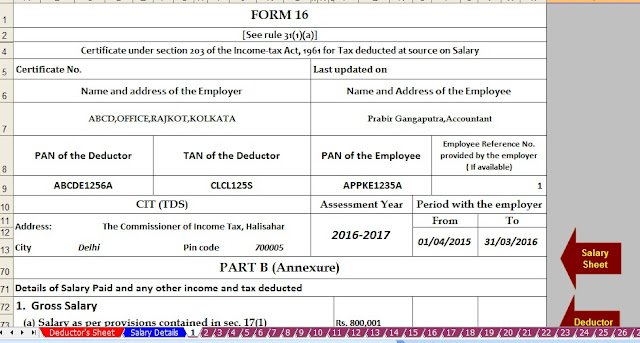

Download Automated TDS on Salary All in One for Non-Govt Employees for F.Y.2016-17 & A.Y.2017-18 [

This Excel Based Utility can prepare at a time Individual Tax Compute

Sheet + Individual Salary Structure + Individual Salary Sheet +

Automatic H.R.A. Exemption Calculation U/s 10(13A) + Automated Form 16

Part A&B and Form 16 Part B for F.Y.2016-17 as per the Finance

Budget 2016]

1.

Tax Benefits

1.

Tax

exemption under section 80C up

to a limit of Rs. 1,50,000.

2.

Interest

is tax free. It is not taxable at the time of accrual nor at the time of

receipt. Premature withdrawal is also exempt from tax.

3.

Tax

exemption under section 80C can be availed by parents in case of deposits by

minor. Total amount deposited by parent along with minor cannot exceed Rs.

1,50,000 thus total deduction under section 80C cannot

exceed Rs. 1,50,000 in any case.

2. Interest

Interest

rate is decreased to 8.10% for the year 2016-17.

Interest is

compounded annually and credited at the end of every financial year. If amount

is deposited on or before 5th of the month then interest is credited for the

whole month otherwise interest will not be given for the whole month. Interest

is not calculated day wise but calculated monthly.

PPF Interest Rate Chart

Financial

Year

|

PPF

Interest Rate

|

2000-01

|

11%

|

2001-02

|

9.5%

|

2002-03

|

9%

|

2003-04

|

8%

|

2004-05

|

8%

|

2005-06

|

8%

|

2006-07

|

8%

|

2007-08

|

8%

|

2008-09

|

8%

|

2009-10

|

8%

|

2010-11

|

8%

|

2011-12

|

8.6%

|

2012-13

|

8.8%

|

2013-14

|

8.7%

|

2014-15

|

8.7%

|

2015-16

|

8.7%

|

2016-17

|

8.1%

|

3. Opening PPF A/c

1.

Can

be open in post offices or any authorised banks.

2.

Can

be open by minors.

3.

Can’t

be opened in joint names.

4.

Can’t be opened by HUF, NRI. However, if someone opens a

PPF Account while he is a Resident of India but subsequently becomes a NRI, he

shall be allowed to continue investing in his account.

5.

Nominee

can be appointed by the account holder. After death of account holder, nominee

cannot continue the account.

6.

The

date of realization of cheque in Government account shall be date of opening of

account.

7.

A

Power of attorney holder can neither open or operate a PPF account.

8.

The

grand father/mother cannot open a PPF account on behalf of their minor grand

son/daughter.

9.

A person can open only one PPF

account.

Document required

for opening a PPF account

Account opening form

– Form A

4. Depositing Amount

1.

Maximum

amount that can be deposited in a year is Rs. 1,50,000

2.

After

opening account minimum Rs. 500 is to be deposited each year. Penalty is Rs. 50

for default per financial year.

3.

Amount

can be deposited not more than 12 times in a year and not more than 2 times in

a month.

4.

The

deposits shall be in multiple of Rs.100/- subject to minimum amount of Rs.500.

5.

Amount

can by deposited by cash or cheque or via online payment.

5. Period and Lock in period

PPF account is opened for a period of 15 years. However on

expiry account can be extended to a period of 5 years at a time. It can be

extended any number of times for a period of 5 years each.

Application form H for extension of period

6. Withdrawal of Amount from PPF

There is a

lock-in period of 15 years and the money can be withdrawn in whole after its

maturity period. However, pre-mature withdrawals can be made from the end of

the sixth financial year from the year in which account is opened.

The maximum

amount that can be withdrawn pre-maturely is equal to 50% of the amount that

stood in the account at the end of 4th year preceding the year in which the

amount is withdrawn or the end of the preceding year whichever is lower.After

15 years of maturity, full amount can be withdrawn.

7. Closure of Account

1.

Premature

closure is not allowed before 15 years except in case of death.

2.

Nominee/legal

heir of PPF Account holder on death of the account holder can not continue the

account, but account has to be closed.

8. Documents required for opening PPF account

·

A

recent passport size photograph.

·

Identity

Proof copy with original to verify (Even PAN Card may be accepted as all tax

payers are having it)

·

Address

Proof copy with original to verify

·

Account

opening form for PPF

·

Paying

in slip for PPF a/c

·

Nomination

form for PPF

9.PPF Forms

1.

Form

A – To open a Public Provident Fund (PPF) Account

2.

Form

B – To deposit amount in PPF Account or to repay loans taken against PPF

account

3.

Form

C – To make partial withdrawals from a PPF account

4.

Form

D – To request a loan against a PPF account

5.

Form

E – To add a nominee to a PPF account

6.

Form

F – To make changes to PPF account nomination information

7.

Form

G – To claim funds in a PPF account by a nominee/legal heir

8.

Form

H – To extend the maturity period of a PPF account

10. List of Banks where PPF Account can be opened

·

State

Bank of India

(SBI)

·

ICICI

Bank

·

Axis

Bank

·

State

Bank of Travancore

·

State

Bank of Hyderabad

·

State

Bank of Mysore

·

State

Bank of Bikaner

and Jaipur

·

State

Bank of Patiala

·

Allahabad

Bank

·

Bank

of Baroda

·

Bank

of India

·

Bank

of Maharashtra

·

Canara

Bank

·

Central

Bank of India

·

Corporation

Bank

·

Dena

Bank

·

IDBI

Bank

·

Indian

Overseas Bank

·

Oriental

Bank of Commerce

·

Punjab

National Bank

·

Union

Bank of India

·

United

Bank of India

·

Andhra

Bank

·

Vijaya

Bank

·

Punjab and Sind Bank

·

Uco

Bank

11. Extension of Account beyond 15 years

Basic period

of the account is 15 years however account holders can choose to extend the

tenure. Tenures can be extended in 5-year blocks with or without making further

investments.

·

If no fresh investments are

made after maturity, the account can continue earning

interest on the amount accrued in the account until the end of year 15. Also,

in this case, funds can be withdrawn freely once every financial year.

·

If fresh investments are made

after maturity – The interest will be calculated as

per available balance in account. However, in this case, withdrawals will be

restricted to a maximum of 60% of the amount held in the account at the start

of each 5-year period of extension.