For a person earning income from Salary, documents Form 16, and Form 12 BA are provided by an employer which has details about his salary, perquisites, and tax deducted at source(TDS) by his employer. These are used while calculating Tax liability. Tax on income we looked into details of Form 16. Form 12 BA give details of Perquisites given by the employer to employee. In Perquisites, we had looked into what are perquisites, what income tax laws apply to it, about the valuation of perquisites and the taxation with an example, which perquisites are exempted from tax, Difference between Prerequisite, Allowance and Fringe benefit. In this article, we shall see how Form 12 BA shows the information about perquisites.

Showing posts with label Income Tax Form 12 BA in Excel Format. Show all posts

Showing posts with label Income Tax Form 12 BA in Excel Format. Show all posts

Friday, 1 June 2018

Sunday, 1 October 2017

The Central Finance Budget has already passed by the Parliament for the Financial Year 2017-18 and also some changes have made in this Finance Budge, The Section 87A will be continue and reduce Tax Rebate From Rs. 5,000/ to 2,500 and U/s 80 TTA (the Savings Bank Interest also entitled in this Financial Year 2017-18), K.V.P. has introduce , P.P.F. Limit has increase up to Rs. 1,50,000/- & Pension Fund U/S 80CC Max Rs.1.5 Lakh.

Friday, 3 February 2017

The impact of Deductions available under various sections of Income Tax Act is not same for all. It depends upon applicable tax rates as per the total taxable income and status of assessees. An assessee, whose income is taxable at higher rates will have more tax savings i.e. more impact on his / her tax liability than the assessee whose income is taxable at lower rates.

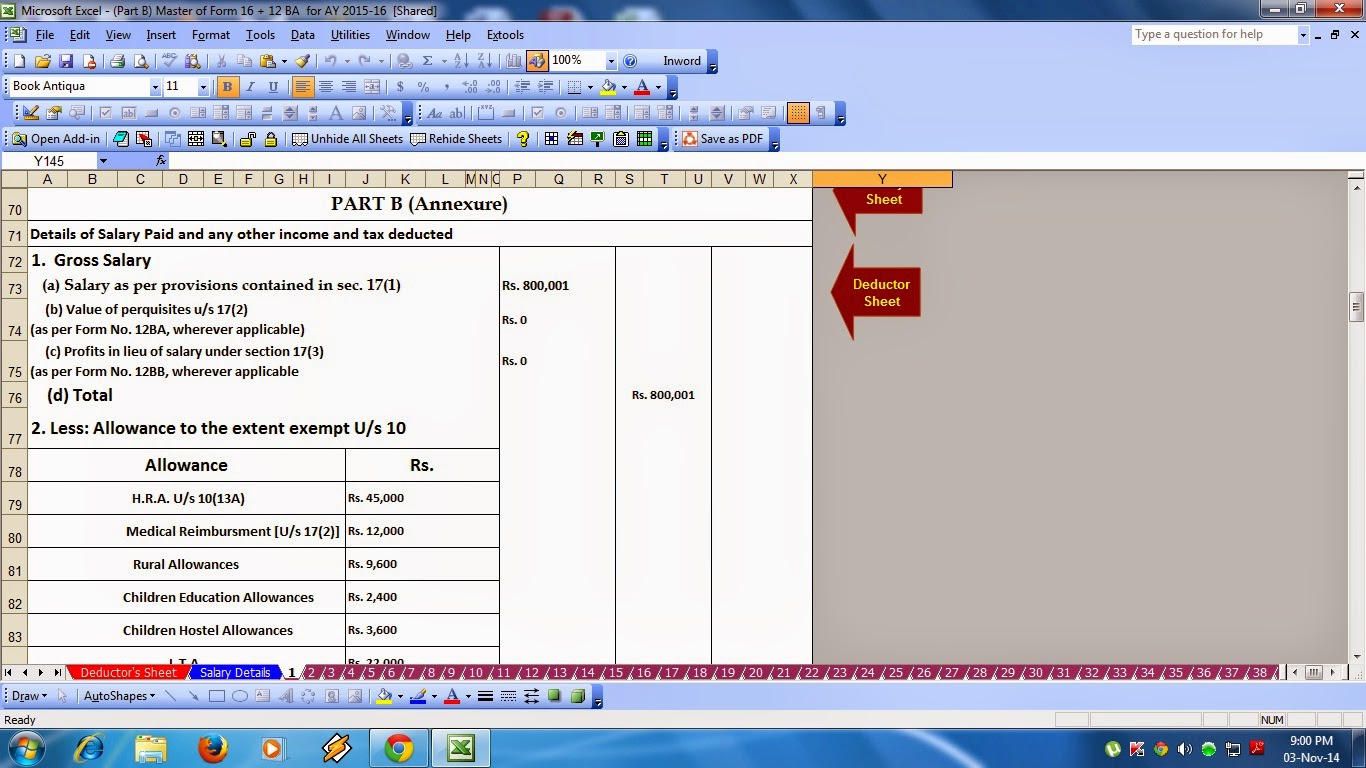

Download and Prepare at a time 50 employees Form 16 Part B with 12 BA for F.Y.2016-17 [ This Excel Utility can prepare at a time 50 employees Form 16 Part B with Form 12 BA for F.Y.2016-17]

Deductions Allowable under various sections of Chapter VIA of Income Tax Act:

• Section 80C – Subject to the overall limit of Rs. 1,50,000 under Section 80CCE, Additional deduction U/s 80CCD(2) & U/s 80CCD(1B)

For investments in specified schemes, saving instruments etc.

1. Life insurance premium for policy:

a) in the case of an individual, on the life of assessee, assessee’s spouse and any child of assessee

b) in the case of HUF, on the life of any member of the HUF

a) in the case of an individual, on the life of assessee, assessee’s spouse and any child of assessee

b) in the case of HUF, on the life of any member of the HUF

2. The sum paid under a contract for a deferred annuity:

a) in the case of an individual, on the life of the individual, individual’s spouse and any child of the individual (however, the contract should not contain an option to receive a cash payment in lieu of annuity)

b) in the case of HUF, on the life of any member of the HU

a) in the case of an individual, on the life of the individual, individual’s spouse and any child of the individual (however, the contract should not contain an option to receive a cash payment in lieu of annuity)

b) in the case of HUF, on the life of any member of the HU

3. Sum deducted from salary payable to Government servant for securing deferred annuity or making provision for his wife/children [qualifying amount limited to 20% of salary]

4. Contributions by an individual made under Employees’ Provident Fund Scheme

5. Contribution to Public Provident Fund Account in the name of:

a) in the case of an individual, such individual or his spouse or any child of such individual

b) in the case of HUF, in the name of any member thereof

a) in the case of an individual, such individual or his spouse or any child of such individual

b) in the case of HUF, in the name of any member thereof

6. Contribution by an employee to a recognized provident fund

7. Contribution by an employee to an approved superannuation fund

8. Subscription to any notified security or notified deposit scheme of the Central Government.

For this purpose, Sukanya Samriddhi Account Scheme has been notified vide Notification No. 9/2015, dated 21/1/2015. Any sum deposited during the year in Sukanya Samriddhi Account by an individual would be eligible for deduction. The amount can be deposited by an individual in the name of her girl child or any girl child for whom such an individual is the legal guardian.

For this purpose, Sukanya Samriddhi Account Scheme has been notified vide Notification No. 9/2015, dated 21/1/2015. Any sum deposited during the year in Sukanya Samriddhi Account by an individual would be eligible for deduction. The amount can be deposited by an individual in the name of her girl child or any girl child for whom such an individual is the legal guardian.

9. Subscription to notified savings certificates [National Savings Certificates (VIII Issue)]

10. Contribution for participation in unit-linked Insurance Plan of UTI:

a) in the case of an individual, in the name of the individual, his spouse or any child of such individual

b) in the case of an HUF, in the name of any member thereof

a) in the case of an individual, in the name of the individual, his spouse or any child of such individual

b) in the case of an HUF, in the name of any member thereof

11. Contribution to notified unit-linked insurance plan of LIC Mutual Fund:

a) in the case of an individual, in the name of the individual, his spouse or any child of such individual

b) in the case of an HUF, in the name of any member thereof

a) in the case of an individual, in the name of the individual, his spouse or any child of such individual

b) in the case of an HUF, in the name of any member thereof

12. Subscription to notified deposit scheme or notified pension fund set up by National Housing Bank [Home Loan Account Scheme/National Housing Banks (Tax Saving) Term Deposit Scheme, 2008]

13. Tuition fees (excluding development fees, donations, etc.) paid by an individual to any university, college, school or other educational institution situated in India, for full-time education of any 2 of his/her children

14. Certain payments for purchase/construction of residential house property

15. Subscription to notified schemes of (a) public sector companies engaged in providing long-term finance for purchase/construction of houses in India for residential purposes/(b) authority constituted under any law for satisfying need for housing accommodation or for planning, development or improvement of cities, towns, and villages, or for both

16. Sum paid towards notified annuity plan of LIC or another insurer

17. Subscription to any units of any notified [u/s 10(23D)] Mutual Fund or the UTI (Equity Linked Saving Scheme, 2005)

18. Contribution by an individual to any pension fund set up by any mutual fund which is referred to in section 10(23D) or by the UTI (UTI Retirement Benefit Pension Fund)

19. Subscription to equity shares or debentures forming part of any approved eligible issue of capital made by a public company or public financial institutions

20. Subscription to any units of any approved mutual fund referred to in section 10(23D), provided the amount of subscription to such units is subscribed only in ‘eligible issue of capital’ referred to above. 21. Term deposits for a fixed period of not less than 5 years with a scheduled bank, and which is in accordance with a scheme framed and notified.

21. Subscription to notified bonds issued by the NABARD.

22. Deposit in an account under the Senior Citizen Savings Scheme Rules, 2004 (subject to certain conditions)

23. 5-year term deposit in an account under the Post Office Time Deposit Rules, 1981 (subject to certain conditions)

• Section 80CCC (Premium for annuity plans)

• Section 80CCD(1) (Assessee's contribution to pension a/c)

• Section 80CCD(2) (Employer's contribution to pension a/c)

• Section 80CCD (Additional contribution to NPS)

• Section 80CCG

• Section 80D (Medical/health insurance)

• Section 80DD (Reh. of handicapped dependent relative)

• Section 80DDB (Medical ex. on self/dependent relative)

• Section 80E (Inst. on loan for higher studies)

• Section 80G (Donations)

• Section 80EE (Int. on loan for residential house property)

• Section 80G (Donations)

• Section 80GG (House rent)

• Section 80GGA (Donations)

• Section 80GGC (Sci. Research/Rural Dev.)

• Section 80RRB (Royalty on patents)

• • Section 80TTA (Saving bank in.)

• Section 80U (Physical disability)

• Section 24 (Home loan int.)

• Section 80CCD(1) (Assessee's contribution to pension a/c)

• Section 80CCD(2) (Employer's contribution to pension a/c)

• Section 80CCD (Additional contribution to NPS)

• Section 80CCG

• Section 80D (Medical/health insurance)

• Section 80DD (Reh. of handicapped dependent relative)

• Section 80DDB (Medical ex. on self/dependent relative)

• Section 80E (Inst. on loan for higher studies)

• Section 80G (Donations)

• Section 80EE (Int. on loan for residential house property)

• Section 80G (Donations)

• Section 80GG (House rent)

• Section 80GGA (Donations)

• Section 80GGC (Sci. Research/Rural Dev.)

• Section 80RRB (Royalty on patents)

• • Section 80TTA (Saving bank in.)

• Section 80U (Physical disability)

• Section 24 (Home loan int.)

Sunday, 18 December 2016

In an emerging market economy with high inflation rates such as India, it is only wise for people to save, invest and spend effectively in order to meet a general increase in prices and fall in the purchasing value of money over time. People’s savings are necessary to sustain an optimum level of demand which boosts manufacturing, services and thereby jobs in the economy.

The government encourages people to save by providing tax deductions to those who do it. The income tax code provides income tax deductions under Section 80C to Section 80U for various investments, expenses, and payments made by the individual or a Hindu Undivided Family (HUF) in a given financial year.

Download All in One Income Tax Preparation Excel Based Software for Non-Govt ( Private) Employees for F.Y.2016-17 & A.Y.2017-18

[ This Excel Utility can prepare at a time Individual Salary Sheet + Individual Salary Structure + Individual Tax Computed Sheet + Automatic H.R.A. Calculation + Automated Form 16 Part A&B and Form 16 Part B + Automated Form 12 BA for F.Y.2016-17]

Tax Deductions available under section 80 of Income Tax Act, 1961

Section 80C (Individual & HUF)

In all, total deductions under section 80C, 80CCC, and 80CCD (1) cannot exceed Rs 1.50 lakh for the current assessment year. Which means total investments, expenses, and payments up to a limit of Rs 1.50 lakh are eligible for tax deductions mentioned in the above-mentioned sections. These sections cover many savings schemes like National savings certificates (NSCs), Public Provident Fund (PPF) and other pension plans, life insurance premiums, government bond investments. Here’s a section-wise breakup of deductions and exemptions available under the above-mentioned codes:

Section 80CCC (Individual)

This section provides tax deductions for any investments made in an annuity plan or Life Insurance Corporation (LIC) or pension received under funds mentioned in Section 10(23AAB).

Section 80CCD (1) (Individual)

The deductions under this section are aimed at encouraging people to save. These deductions are allowed to people who avail the National Pensions savings scheme (NPS). Under this, an individual can avail a deduction of up to 10 percent of his/her salary or Rs 1.50 lakh whichever is lower if the person has employed or the lower of Rs 1.50 lakhs or 10 percent of gross income, if the individual is self-employed.

Section 80CCD (2) (Individual)

This is applicable in the case of employer’s contribution. The maximum deduction of 10% of salary.

Section 80CCD (1B) (Individual)

For the financial year 2015-16 or assessment year 2016-17, this new section provides for an additional tax deduction for the amount contributed to NPS of up to Rs 50,000. So for AY2016-17, total deductions under Section 80 are available up to Rs 200,000.

Section 80CCG (Individual but not for NRI)

Lesser of 50% of stock investment value or RS 25000 is allowed to those stock investors whose annual income is below Rs.12 lakh-a-year under Rajiv Gandhi Equity Saving Scheme (RGESS).

Section 80D (Individual & HUF)

Deduction up to Rs.25,000 for self, spouse, and dependent children and separate deduction of Rs.30,000 for parents is allowed for the premium paid towards medical insurance.

Section 80DD (Individual & HUF)

Deduction of expenses incurred on medical treatment of Dependent Relative is fixed at Rs.75,000 for 40% disability and Rs.1,25,000 for severe i.e. 80% disability. Claimant is required to furnish the certificate of disability from prescribed authority.

Section 80DDB (Individual & HUF)

Deduction in respect of specified disease for self or dependent relatives is allowed lower of Rs.60,000 or the actual amount paid. This deduction amount increases to Rs.80,000 in the case of a senior citizen.

Section 80E (Individual)

The deduction is also available on interest outgo on education loan for higher studies. This loan could be taken by the assessee, spouse or children or a student for whom the assessee is a legal guardian.

Section 80G (All Assessee)

Donations given to various specified institutions and organizations are allowed to be deducted from your income. The deductions are segregated into two categories i.e. 100% or 50% but cash donations exceeding Rs.10,000 is not allowed to claim.

Section 80GG (Individual)

A deduction on house rent paid is available to those who are not paid house rent allowance (HRA) by the employer. An individual, spouse or minor children shouldn’t own a home at the place of employment of the assessee to claim this deduction. Neither the assessee should have a self-occupied residence at any other place. The deduction available is limited to rent minus 10% of total income or 25% of total income or Rs 2000 (whichever is lower).

Section GGB & GGC (All Assessee)

Even donations given to political party are allowed for deduction without any restriction, but if it’s in cash and exceeding Rs.10,000, the deduction becomes ineligible.

Section 80RRB (Individual)

Any Individual assessee who is patentee can claim deduction up to Rs.3 lac. The assessee has to furnish a patent certificate duly signed by the competent authority.

Section 80TTA (Individual & HUF)

Any interest earned (up to Rs 10,000) on your deposits in a savings bank account, co-operative society or post office is tax deductible. This excludes fixed deposit interest income.

Section 80U (Individual & HUF)

Physically Disabled persons can claim deductions under 80U of Rs.75000/- for below 80 % and Rs. 1,25,000/- for above 80%. The assessee is required to obtain the certificate from Government Doctor.

Section 87A ( Individual & HUF)

Apart from the above deductions another important deduction for the assessee having taxable income below Rs.5 lakh is available u/s 87A. As per the Finance Bill 2016-17, the Section 87A Tax Rebate has amended from Rs. 2,000/- to 5,000/-

Monday, 21 November 2016

Download Automated Master of Form 16 Part B with Form 12 BA FY 2016-17 [ This Excel Utility can prepare at a time 50 employees Form 16 Part B with 12 BA for Financial Year 2016-17]

For the person earning income from Salary , documents Form 16, and Form12BA

are provided by an employer which has details about his salary,

perquisites and tax deducted at source(TDS) by his employer.Looked into

details of Form 16. Form 12BA give details of Perquisites given

by the employer to the employee had looked into what are perquisites,

what income tax laws apply to it, about the valuation of perquisites and

the taxation with an example, which perquisites are exempted from

tax, Difference between Perquisite, Allowance, and Fringe benefit. In

this article, we shall see how Form 12BA shows the information about perquisites.

Form 12BA

Form 12BA is

a statement showing particulars of perquisites, other fringe benefits

or amenities, and profits in lieu of salary with value thereof.

Form

No. 12BA, if the amount of salary paid or payable to the employee is

more than one lakh and fifty thousand rupees, which shall accompany the

return of income of the employee. [Explanation : “Salary” for the

purposes of this rule shall have the same meaning as given in rule 3.]

Note:The limit has changed to one lakh and eight thousand (1,80,000) by circular in 2011.

Saturday, 5 November 2016

Download Automated Master of Form 16 Part B with Form 12 BA FY 2016-17 [ This Excel Utility can prepare at a time 50 employees Form 16 Part B with 12 BA for Financial Year 2016-17]

For the person earning income from Salary , documents Form 16, and Form12BA are provided by an employer which has details about his salary, perquisites and tax deducted at source(TDS) by his employer.Looked into details of Form 16. Form 12BA give details of Perquisites given by the employer to the employee had looked into what are perquisites, what income tax laws apply to it, about the valuation of perquisites and the taxation with an example, which perquisites are exempted from tax, Difference between Perquisite, Allowance, and Fringe benefit. In this article, we shall see how Form 12BA shows the information about perquisites.

Form 12BA

Form 12BA is a statement showing particulars of perquisites, other fringe benefits or amenities, and profits in lieu of salary with value thereof.

Form No. 12BA, if the amount of salary paid or payable to the employee is more than one lakh and fifty thousand rupees, which shall accompany the return of income of the employee. [Explanation : “Salary” for the purposes of this rule shall have the same meaning as given in rule 3.]

Note:The limit has changed to one lakh and eight thousand (1,80,000) by circular in 2011.

Thursday, 20 October 2016

Download the Automated Master of Form 16 Part B with 12 BA for prepare at a time 50 Employees Form 16 Part B with 12 BA for Financial Year 2016-17 and Assessment Year2017-18.

Feature of this Excel Utility :-

1) Automatic Prepare at a time 50 employees Form 16 Part B with 12 BA for F.Y.2016-17

2) Most easy to generate this Excel Utility, just like any Excel File

3) You can prepare more than 1000 employees Form 16 Part B with 12 BA by this One Software.

4) Automatic Convert the Amount into the In Word without any Excel Formula

5) All amended Income Tax Section have in this utility as per the Finance Bill 2016-17

Wednesday, 27 January 2016

Budget 2015 has been introduced in Parliament. The Finance Minister has kept the Personal Income Tax rates unchanged for the Financial Year 2015 /2016 (Assessment Year 2016-2017).

He has to introduce or extend the Tax Deduction limits Under few Sections of the Income Tax Act.

Let us understand all the important sections and new introduce with respect to ‘Income Tax Deductions 2015′. This list will help you in planning your taxes.

Tuesday, 24 March 2015

Click to download Automated Master of Form 16 Part B with Form 12 BA for the FY 2014-15 [ This Excel Based Utility can prepare at a time 50 employees Form 16 Part B with 12 BA]

For person earning

income from Salary , documents Form 16, and Form 12 BA are provided by

employer which has details about his salary, perquisites and tax deducted at

source(TDS) by his employer. These are used while calculating Tax liability. Tax on income we looked into details of Form

16. Form

12 BA give details

of Perquisites given

by the employer to employee. In Perquisites we had

looked into what are perquisites, what income tax laws apply to it, about

valuation of perquisites and the taxation with an example,

which perquisites are exempted from tax, Difference between

Perquisite, Allowance and Fringe benefit. In this article we shall see how Form 12 BA shows the information about

perquisites.

Form 12 BA

Form 12BA is statement

showing particulars of perquisites, other fringe benefits or amenities and

profits in lieu of salary with value thereof. It comes under the Section 26A, subsection 2 point B.

Form No. 12BA, if the amount of salary paid or payable to the employee

is more than one lakh and fifty thousand rupees, which shall accompany the

return of income of the employee. [Explanation : “Salary” for the purposes of

this rule shall have the same meaning as given in rule 3.]

Note:The

limit has changed to one lakh and eight thousand (1,80,000) by circular in

2011.

Please don’t confuse Form

12BA with Form 12B, difference is more than just the one letter . Form

12B comes into picture when people change job in the middle of the Financial year.

Details of previous employment

to the new employer are provided by the employee in Form 12B. Changing

jobs often leads to a situation where an individual gets tax exemptions twice

than what is due to him—from his earlier employer as well as from his new

employer. The income earned from the previous job has to be clubbed with

the income from the new job to compute the total tax payable for the year. Changing Jobs:Take Care Of Bank Account,Tax Liability discusses

it in detail.

According

to section 192, it is the option / discretion of the employee whether or not to

file Form No 12B. The current employer can’t insist on filing of Form No 12B.

If the employee chooses not to file, then employers’ obligation is limited to

compute TDS on salary payable by him.

If Form

12B is filed, then current employer can deduct the TDS on salary paid by

previous employer (in case no TDS was deducted by previous employer). And if

the TDS was deducted by previous employer, any excess or shortfall can also be

adjusted.

It is

always in the interest of an employee to furnish such details because otherwise

there can be duplication of exemptions and deductions and there can be a

shortfall in tax deduction and as a result the employee would become liable to

deposit advance tax.

Click to download Automated Master of Form 16 Part B with Form 12 BA for the FY 2014-15 [ This Excel Based Utility can prepare at a time 50 employees Form 16 Part B with 12 BA]

Tuesday, 24 February 2015

Leave Travel Allowance (LTA)

LTA is one of the most common elements of compensation offered by employers to employees mainly due to the tax benefits attached to LTA. This is also known as Leave Travel Concession [LTC] Section 10(5) of the Income-Tax Act, 1961, read with Rule 2B, provides for the

exemption and outlines the conditions for exempting LTA.

exemption and outlines the conditions for exempting LTA.

Click here to Download the Automatic Form 16 Part B with 12 BA for Ass Yr 2015-16 [This Excel utility can prepare at a time 50 employees Form 16 Part B with 12 BA ]

Who can claim exemption:-

LTA exemption can be claimed by an employee for his travel to any place in India

with or without his family.

What is exempt:-

Only fare charges are exempt from tax. This means that expenses such as food, hotel stay etc. not eligible for exemption.

Exemption available every year ?

No. The tax rules provide for exemption only in respect of two journeys performed in a block

of four calendar years. This means that one can claim exemption for his travel performed in two times in a block of 4 years.

The current block runs from 2010-2013. Next block is 2014-2017. If an individual does not use his exemption during any block on any one or on both occasions, their exemption can be carried over to the next block and used in the calendar year immediately following that block.

To put it differently, if a taxpayer has not able to claim both the exemption in a block of 4 years or he has claimed only one exemption in a block of 4 years, he can carry forward the exemption to the next block and this is to be claimed in the 1st year of the next block.

Saturday, 6 December 2014

Automatic Master of Form 16 Part B with 12 BA for the Financial Year 2014-15 and Assessment Year 2015-16( Prepare at a time 50 employees Form 16 Part B with 12 BA)

Prepare at a

time 50 employees Form 16 with 12 BA for the Ass Year 2014-15 by this

one Excel Based Software. You can prepare more than 1000 employees Form

16 with 12 BA. First you can prepare 50 employees form 16 with 12 BA and

Save the Same in another Name and Location. After Saved the 50

employees Form 16, prepare another 50 employees Form 16 with 12 BA and

save the same as before.

Deductor Details Sheet

Tax Deduction Section Wise Sheet

Form 16 Part B

Form 12 BA

Deductor Details Sheet

Tax Deduction Section Wise Sheet

Form 16 Part B

Form 12 BA

- It is most easy to prepare more than 1000 employees Form 16 with 12 BA by this One Software (Excel Based).

- Automatic Calculate the each employees Income Tax Liability

- Automatic Convert the Amount in to the in words without install any Add-ins or any Macro

- Easy to generate, as this Software based only on the Excel

- Prepare at a time 50 employees Form 16 Part B with 12 BA

Saturday, 15 November 2014

Free download Automated Income Tax Form 16 Part B for the Financial Year 2014-15 [ This Excel Based Software can prepare at a time 100 employees Form 16 Part B for the Financial Year 2014-15]

What is

Form 16?

Every

year your employer will issue this document. It is a certificate under section

203 of the Income-Tax Act, 1961, which gives information on the tax deducted at

source (TDS) from income chargeable under the head “salaries”. Simply put, it

gives details of the tax deducted by the employer. If you have not received

your Form 16, you can use the worksheet that the income tax (I-T) department

provides to calculate and declare the amount.

Form 16

is useful in filing your income tax return (ITR). What’s inside it?

Understanding the content of Form 16 helps you file your I-T returns; you may

be able to do it yourself, without help from a chartered accountant or a

financial planner, especially if your income comes entirely from your salary,

and you have no other source of income.

Click here to download Automatic Form 16 Part B [ Prepare at a time 50 employees Form 16 Part B for the Financial Year 2014-15]

Form 16

has two sections—part A and part B. Part A consists of your personal details

such as your name and address, your employer’s name and address, Permanent

Account Number (PAN) of both, the employer’s Tax Deduction Account Number

(TAN), and others.

These

details help the I-T department track the flow of money from your and your

employer’s accounts. Part A also gives details such as the assessment year

(AY)—the year in which your tax liability is calculated for the income earned

the previous year. For example, for income earned between 1 April 2013 and 31

March 2014, AY will be 2014-15. This year’s Form 16 will show 2014-15. This

portion of the form also gives details of your period of employment with the

current employer. For instance, if in the last financial year, you have worked

from 1 April 2013 to 31 March 2014, it will be mentioned in the form. Next, it

gives a summary of the TDS by the employer on behalf of the employee.

Click here to Download Master of Form 16 Part A&B For Financial Year 2014-15 [ This Excel Based Software can prepare at a time 100 employees Form 16 Part A&B]

This is

the amount that the employer deducts from your salary as tax periodically and

credits it to the I-T department. For instance, if every month your employer

deducts Rs.3,000 as tax from your salary, it will be shown in the Form 16 as

deposited by your employer to the government. The summary space will be divided

based on the periodicity of how your employer credits the tax to the I-T

department. Part B of Form 16 is the one that gives most of the details that

you need to file I-T return, such as salary paid, other income, tax deducted,

and more.

Click here to download Automatic Form 16 Part B with Form 12 BA [ This Excel Based Software can prepare at a time 50 employees Form 16 Part B with 12 BA for the Financial Year 2014-15 with all Tax Section]

Your

gross income is mentioned first. Those who need to pay professional tax should

note that the tax is not considered on the gross income. Next, deductions are

mentioned.

These

include those under sections 80C, 80CCC and 80CCD (contributions towards Public

Provident Fund, life insurance policies, pension, among others). Remember, the

aggregate amount deductible under these three sections should not exceed Rs.1.5

lakh.

Then come

the deductions under other sections such as 80D (health insurance premium), 80E

(interest on education loan), 80G (donations), and others. The total deductions

are reduced from the gross income to arrive at the taxable income.

Tax is

calculated on this amount based on your tax slab. How to use it? Form 16 is one

of the documents that you need to keep handy before or while filing your ITR,

which has to be done till 31 July. While all deduction related details are

mentioned in Form 16.

Click here to download All in One Master of Form 16 Part B for Financial Year 2014-15 [This Excel Based Software can prepare at a time 50 employees Form 16 Part B with Individual Salary Sheet + Individual Salary Structure]

Subscribe to:

Posts (Atom)